top of page

All Posts

Are You Making These Common Florida Restaurant Insurance Mistakes in 2025?

Restaurant owners across Florida continue making critical insurance mistakes that expose their businesses to unnecessary financial risks. These oversights range from fundamental coverage gaps to documentation failures that can compromise protection when you need it most. Understanding these common mistakes helps restaurant owners build comprehensive protection strategies. Insurance Alliance LLC serves restaurant businesses throughout Florida, Texas, Arizona, Idaho, and Washin

marketing676641

Dec 3, 20255 min read

Looking For Washington Restaurant Insurance? Here Are 10 Things You Should Know Before You Buy

Washington restaurant owners face unique insurance requirements and coverage needs that protect both their business operations and employees. Understanding these essential coverage elements ensures compliance with state regulations while safeguarding your investment against potential risks. Workers' Compensation Insurance Requirements Washington State mandates workers' compensation insurance for all employers with three or more employees. This coverage protects employees wh

marketing676641

Dec 3, 20254 min read

Liquor Liability Insurance Secrets Revealed: What Restaurant Owners Don't Want You to Know

Restaurant owners across Florida, Texas, Arizona, Idaho, and Washington operate under a dangerous misconception that standard general liability insurance protects their business from alcohol-related incidents. This assumption creates a catastrophic coverage gap that exposes establishments to devastating financial risk. General liability insurance explicitly excludes alcohol-related incidents, regardless of staff training quality or operational procedures. When intoxicated pat

marketing676641

Dec 3, 20255 min read

7 Mistakes You're Making with Restaurant Workers Comp (and How to Fix Them Before Your Next Inspection)

Restaurant workers' compensation requirements create compliance challenges that many business owners overlook until inspection time. Understanding common coverage mistakes helps protect your employees and maintain regulatory compliance across all operational areas. Mistake 1: Operating Without Required Workers' Compensation Coverage Many restaurant owners operate without proper workers' compensation insurance, creating significant legal and financial exposure. State regulat

marketing676641

Dec 2, 20255 min read

Business Owners Policy Secrets Revealed: What Restaurant Insurance Experts Don't Want You to Know

Restaurant owners frequently purchase Business Owners Policies believing they have comprehensive coverage. This assumption creates significant protection gaps that become apparent only when claims arise. Understanding the complete scope of Business Owners Policy coverage reveals critical limitations and additional protection needs. What Business Owners Policies Actually Include Business Owners Policies combine three primary coverage components into a single policy structure

marketing676641

Dec 2, 20254 min read

Liquor Liability Insurance in 2025: Why Everyone Is Talking About Market Changes (And You Should Too)

The liquor liability insurance landscape is experiencing significant shifts in 2025, with carriers adjusting their approaches to coverage and restaurant owners paying closer attention to policy features than ever before. Understanding these market changes helps restaurant and bar operators make informed decisions about their insurance portfolios. What Liquor Liability Insurance Covers Liquor liability insurance protects establishments that serve alcoholic beverages from leg

marketing676641

Dec 2, 20254 min read

Recoop Disaster Insurance: How It Benefits Florida Homeowners

Florida homeowners face unique challenges when it comes to disaster preparedness. The state's geographic location makes it particularly vulnerable to hurricanes, storm surge, and severe weather events that can cause significant property damage and financial hardship. Recoop Disaster Insurance provides a specialized solution designed to address the coverage gaps that traditional homeowners insurance often leaves behind. Understanding Recoop Disaster Insurance Recoop Disaster

marketing676641

Nov 27, 20255 min read

Protect Your Home From Multiple Disasters With Recoop: A Multi-State Solution

Natural disasters strike without warning across the United States. Traditional homeowners insurance often leaves coverage gaps that force property owners to face significant out-of-pocket expenses during recovery. Recoop disaster insurance addresses these gaps with comprehensive multi-peril protection designed for today's complex disaster landscape. Revolutionary Multi-Peril Protection Recoop represents the nation's first and only multi-peril disaster insurance coverage. Th

marketing676641

Nov 27, 20254 min read

Recoop Disaster Insurance: Key Coverage Features for Families and Individuals

Recoop represents the first multi-peril disaster insurance designed specifically to provide immediate financial relief following natural disasters. This specialized coverage fills critical gaps left by traditional homeowners and renters insurance policies across Florida, Texas, Arizona, Idaho, and Washington. What Recoop Disaster Insurance Covers Recoop protects against multiple natural disasters that frequently impact families and individuals throughout these states. The c

marketing676641

Nov 27, 20254 min read

Recoop Disaster Insurance for Washington Homeowners: Unique Protection for Earthquakes and More

Washington homeowners face unique disaster risks that traditional homeowners insurance often fails to address adequately. Recoop Disaster Insurance provides specialized multi-peril coverage designed specifically for natural disasters, including earthquakes, wildfires, winter storms, and other catastrophic events that threaten Pacific Northwest properties. This innovative insurance product fills critical gaps in standard homeowners policies by offering rapid financial support

marketing676641

Nov 27, 20255 min read

Recoop Disaster Insurance: What Is It and Who Needs It?

Natural disasters strike without warning across the United States. Homeowners and renters often discover their standard insurance policies leave significant coverage gaps when disaster recovery begins. Recoop Disaster Insurance addresses these gaps with the first and only multi-peril disaster insurance product available to consumers. This innovative coverage pays a lump-sum cash benefit up to $25,000 after qualifying natural disasters. The product fills critical holes in trad

marketing676641

Nov 27, 20255 min read

Flood Insurance Requirements for Florida: Protecting Your Home and Business

Florida's flood insurance landscape has transformed with new state mandates and federal requirements that affect property owners across the state. Understanding these requirements protects your investment and ensures compliance with evolving regulations. Federal Flood Insurance Mandates Federal law requires flood insurance for properties located in Special Flood Hazard Areas when financed through federally-backed mortgages. These areas include zones A, AE, AH, AO, AR, A99,

marketing676641

Nov 27, 20254 min read

Business Flood Insurance in Florida: Key Coverage Options Explained

Florida businesses face significant flood risks from hurricanes, tropical storms, and heavy rainfall. Standard commercial property insurance excludes flood damage, making dedicated flood coverage essential for protecting your business assets. Understanding your coverage options helps you select appropriate protection for your specific business needs. National Flood Insurance Program Coverage Types The National Flood Insurance Program (NFIP) provides the foundation for comme

marketing676641

Nov 27, 20255 min read

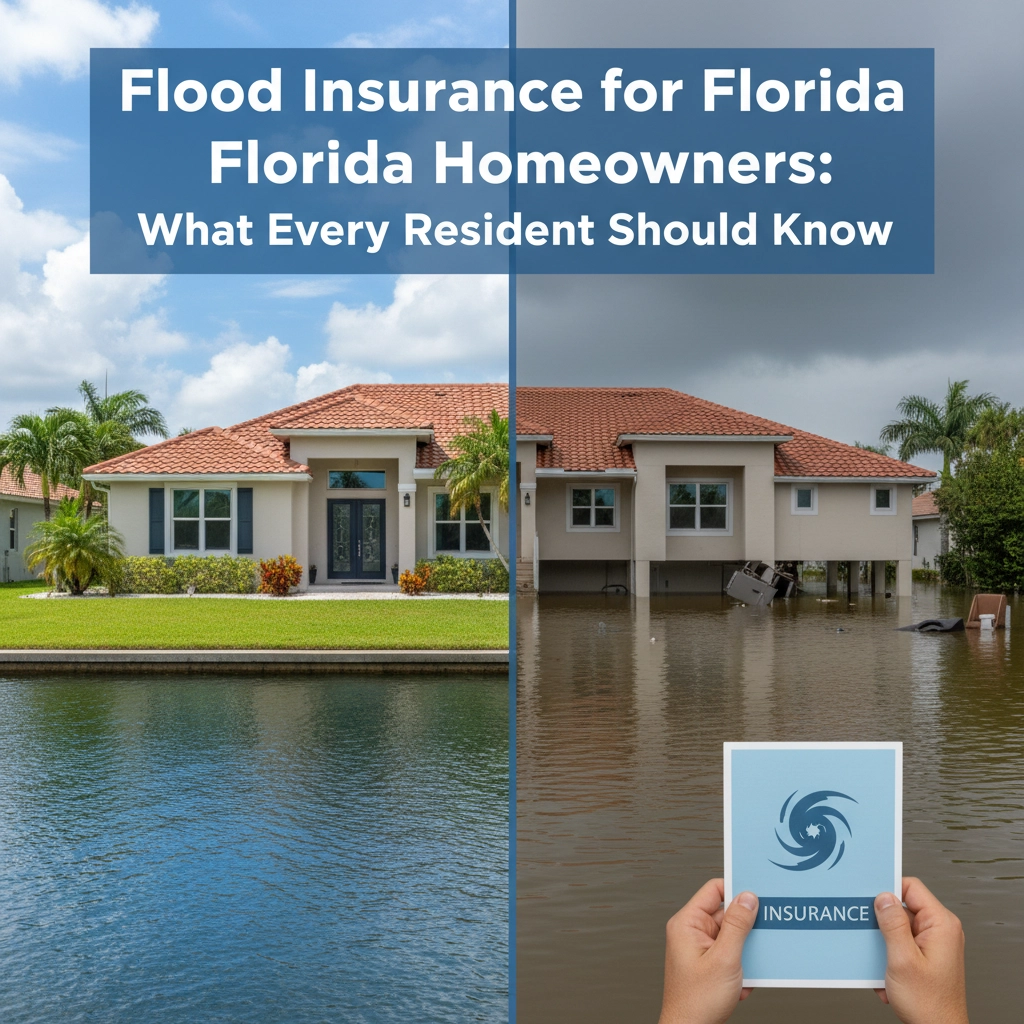

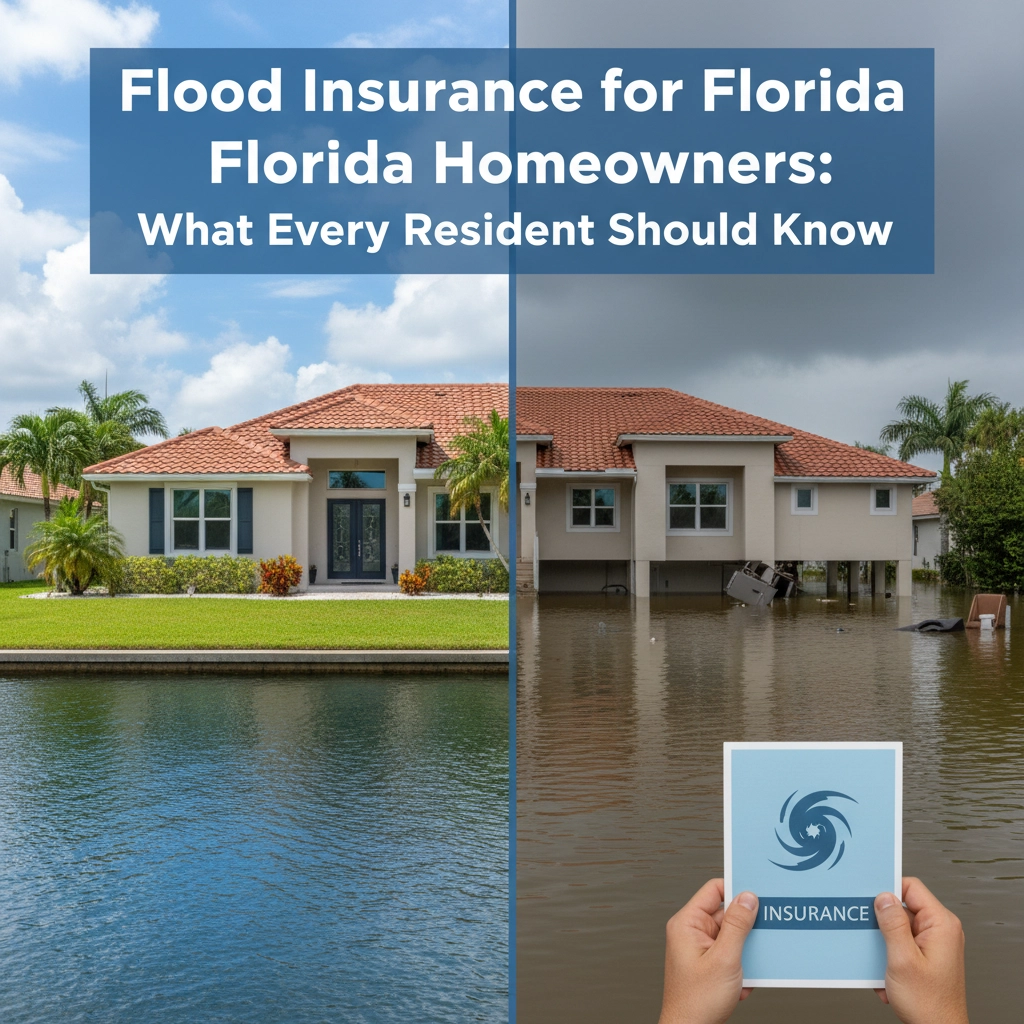

Flood Insurance for Florida Homeowners: What Every Resident Should Know

Florida homeowners face unique flood risks that standard homeowners insurance does not cover. Recent legislation has expanded flood insurance requirements, particularly for Citizens Property Insurance policyholders. Understanding these requirements helps protect your home and financial security. Federal Flood Insurance Requirements Federal law mandates flood insurance for properties with federally backed mortgages located in high-risk flood zones. High-risk areas, designate

marketing676641

Nov 27, 20254 min read

Dentist Office Insurance in Florida: What You Need to Know

Dental practices in Florida face unique insurance requirements and coverage needs that extend far beyond basic business protection. Florida's regulatory framework establishes specific mandates for dental professionals while creating additional considerations for comprehensive practice protection. Understanding these requirements ensures your dental office maintains proper coverage while meeting all state obligations. Mandatory Professional Liability Requirements Florida law

marketing676641

Nov 27, 20255 min read

HVAC Contractor Insurance in Central Florida: What You Need to Know

Central Florida HVAC contractors face unique insurance requirements that combine state mandates, professional licensing standards, and regional risk factors. Understanding these coverage requirements protects your business operations and ensures compliance with Florida's Department of Business and Professional Regulation (DBPR). Florida State Insurance Requirements for HVAC Contractors The DBPR establishes minimum insurance standards for all Division 2 specialty contractors

marketing676641

Nov 27, 20254 min read

Insurance for Flooring Installers: Protecting Your Business the Right Way

Flooring installation businesses face unique risks that require specialized insurance protection. From working with heavy machinery and power tools to handling expensive materials in customers' homes, your operation encounters hazards that generic business insurance cannot adequately address. Professional flooring installers work in environments where property damage, bodily injury, and equipment theft present constant threats to business continuity. Understanding the specifi

marketing676641

Nov 27, 20254 min read

Insurance for Residential Painters: Essential Coverage Explained

Residential painters face significant liability exposures every time they step onto a client's property. Paint spills damage expensive floors. Ladders scratch walls. Equipment trips homeowners. Employees suffer injuries from falls or chemical exposure. Professional painting contractors need comprehensive insurance protection to safeguard their businesses against these daily risks. Most residential property owners require proof of insurance before allowing painters to begin wo

marketing676641

Nov 27, 20255 min read

General Contractor Insurance: What Every Business Needs to Know

General contractors face unique risks that require comprehensive insurance protection. Construction projects involve expensive equipment, multiple workers, potential property damage, and significant liability exposure. Professional contractors operating in Florida, Texas, Arizona, Idaho, and Washington must understand essential coverage requirements and protection strategies. Proper insurance coverage protects your business from financial devastation while ensuring compliance

marketing676641

Nov 27, 20255 min read

Commercial Auto Insurance in Florida: What Business Owners Need to Know

Commercial auto insurance protects Florida businesses from significant financial losses when operating vehicles for work purposes. Understanding coverage requirements ensures compliance with state regulations and provides essential protection for your business operations. Who Must Carry Commercial Auto Insurance Florida businesses operating vehicles for work purposes must maintain commercial auto insurance. This requirement applies to companies that own, lease, rent, or use

marketing676641

Nov 27, 20254 min read

bottom of page