Looking For Cyber Liability Coverage? Here Are 10 Things Medical Offices Should Know About Ransomware

- marketing676641

- Dec 25, 2025

- 4 min read

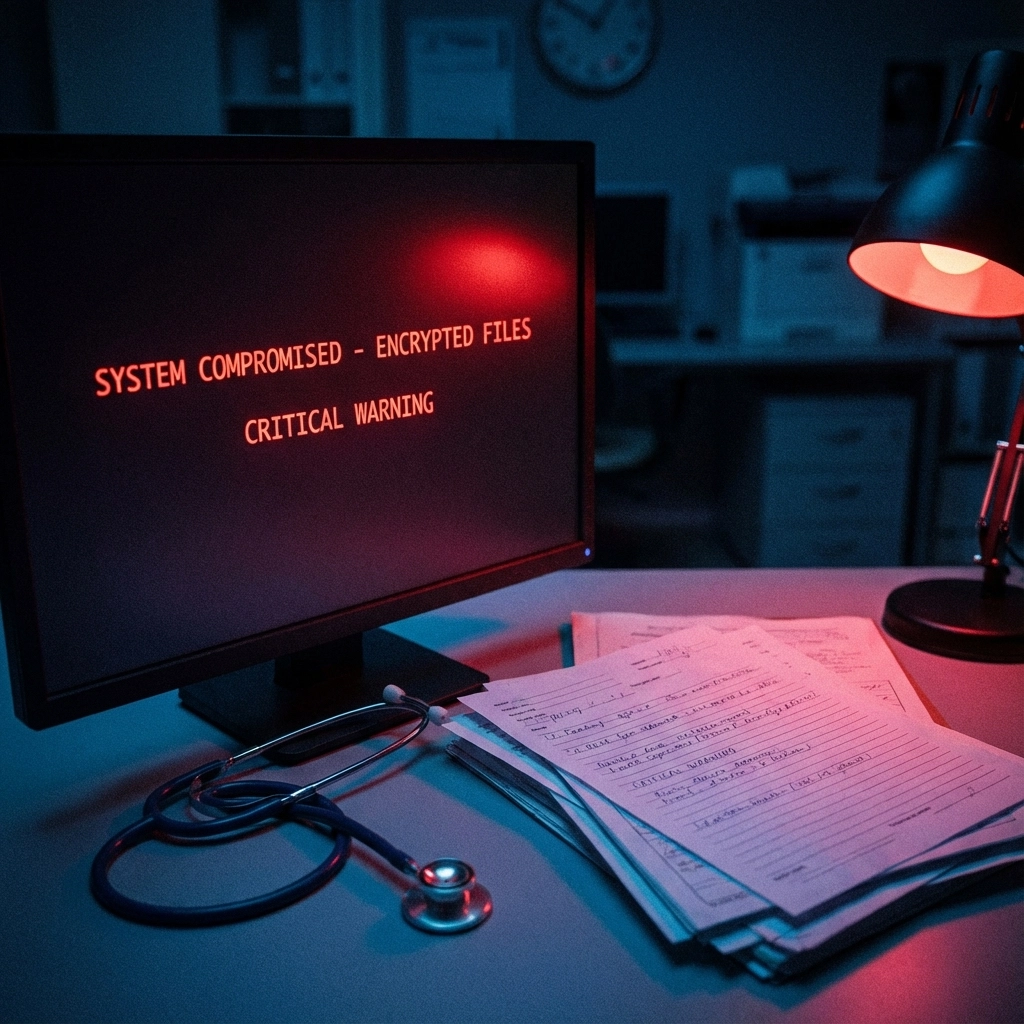

Medical offices across Washington, Florida, Texas, Arizona, and Idaho face increasing ransomware threats daily. These malicious attacks encrypt patient files and demand payment for data release. Cyber liability coverage provides essential protection against ransomware incidents that can devastate medical practices financially.

Understanding ransomware risks and cyber liability coverage helps medical office owners make informed protection decisions. These ten critical points guide medical professionals through ransomware-related cyber liability considerations.

1. Medical Offices Are Prime Ransomware Targets

Healthcare practices store valuable patient data including personal health information, medical records, test results, and billing details. Cybercriminals specifically target medical offices because patient data commands high prices on illegal markets.

Ransomware attacks encrypt entire computer systems and demand payment for data restoration. Medical offices often pay ransoms quickly because patient care depends on immediate system access. This payment pattern makes healthcare facilities attractive targets for repeat attacks.

Professional medical offices, chiropractic clinics, physical therapy centers, and massage therapy practices all maintain electronic patient records. Each practice type faces similar ransomware exposure regardless of specialty or location.

2. Standard Medical Malpractice Insurance Does Not Cover Ransomware

Medical professional liability policies focus on patient care errors and omissions. These policies exclude cyber-related incidents including ransomware attacks. Separate cyber liability coverage addresses technology-related risks that traditional medical malpractice insurance cannot cover.

Many medical office owners assume existing professional liability coverage includes ransomware protection. This assumption creates dangerous coverage gaps that leave practices financially exposed during cyber incidents.

3. Regulatory Fines Can Range from $25,000 to $1.5 Million

HIPAA violations following ransomware attacks trigger substantial regulatory penalties. Fines range from $25,000 to $1.5 million for cases involving willful neglect of patient data security. Cyber liability coverage includes regulatory fine protection that helps medical offices manage compliance-related costs.

State health departments and federal agencies investigate ransomware incidents affecting patient data. These investigations often result in additional compliance requirements and ongoing monitoring costs that cyber liability policies can address.

4. First-Party Cyber Coverage Addresses Direct Ransomware Costs

First-party cyber liability coverage protects medical offices against direct ransomware expenses. This coverage includes security breach response costs, system restoration expenses, and data recovery services. Medical offices need first-party coverage to manage immediate ransomware impact.

Coverage extends to business interruption costs when ransomware attacks prevent normal operations. Physical therapy clinics and chiropractic offices that rely heavily on electronic scheduling systems particularly benefit from business interruption protection.

5. Patient Notification Requirements Create Significant Expenses

Ransomware incidents involving patient data trigger mandatory notification requirements. Medical offices must notify affected patients within specific timeframes about potential data exposure. Cyber liability coverage includes patient notification costs and credit monitoring services.

Notification expenses include postage, printing, call center services, and legal review of communication materials. Large medical practices with thousands of patients face substantial notification costs that cyber liability coverage helps manage.

6. Investigation and Forensic Analysis Costs Are Substantial

Ransomware incidents require professional forensic investigation to determine attack scope and data exposure. Cybersecurity experts charge significant fees for incident response services that medical offices cannot avoid. Cyber liability coverage includes investigation and forensic analysis expenses.

Medical offices must understand exactly which patient data was compromised to meet regulatory reporting requirements. Professional forensic analysis provides documentation necessary for compliance reporting and legal defense.

7. Legal Defense Coverage Protects Against Patient Lawsuits

Ransomware incidents often result in patient lawsuits claiming inadequate data protection. Cyber liability policies include legal defense coverage for lawsuits arising from cyber incidents. This coverage pays attorney fees, court costs, and settlement amounts when appropriate.

Medical offices face potential class-action lawsuits when large numbers of patients are affected by ransomware attacks. Legal defense costs can exceed hundreds of thousands of dollars without proper cyber liability protection.

8. Network Security Liability Covers Third-Party Damages

Network security liability protects medical offices when ransomware spreads from their systems to other organizations. This coverage addresses claims from business partners, vendors, or affiliated medical practices that suffer damages from ransomware originating in your network.

Medical offices that share systems with other healthcare providers face particular exposure for third-party damages. Electronic health record systems and billing platforms create connection points where ransomware can spread between organizations.

9. Coverage Limits Must Match Potential Exposure Levels

Cyber liability coverage limits should align with potential ransomware incident costs. Basic policies offer $50,000 coverage limits that may prove insufficient for significant ransomware attacks. Medical offices should evaluate higher coverage limits based on practice size and patient volume.

Premium costs vary based on healthcare specialization, cyber risk levels, and sensitive data volumes. Medical offices can obtain enhanced cyber liability limits through stand-alone policies or endorsements to existing business insurance.

10. Prevention and Response Planning Reduce Premium Costs

Insurance carriers evaluate cybersecurity practices when determining cyber liability premiums. Medical offices with strong cybersecurity measures and incident response plans often receive favorable premium rates. Employee training, system backups, and security software demonstrate risk management commitment.

Cyber liability carriers provide risk assessment tools and training resources to help medical offices improve cybersecurity posture. These resources help practices prevent ransomware attacks while maintaining competitive insurance rates.

Cyber Liability Coverage Options for Medical Offices

Medical offices can obtain cyber liability coverage through several approaches. Stand-alone cyber liability policies provide comprehensive protection specifically designed for cyber risks. Business owner policies and general liability policies may offer cyber liability endorsements for basic protection.

Massage therapy offices, physical therapy clinics, and chiropractic practices should evaluate stand-alone cyber policies for comprehensive ransomware protection. These specialized practices often maintain detailed patient records that require enhanced cyber liability coverage.

Medical offices that handle patient data electronically need cyber liability coverage to protect against ransomware threats. Professional medical liability insurance cannot address cyber-related risks that increasingly affect healthcare practices.

Implementation and Risk Management

Medical office owners should assess current cybersecurity practices and insurance coverage gaps. Cyber liability coverage evaluation includes analyzing patient data volumes, electronic system dependencies, and potential financial exposure from ransomware attacks.

Insurance Alliance LLC provides cyber liability coverage guidance for medical offices throughout Washington, Florida, Texas, Arizona, and Idaho. Professional insurance consultation helps medical practices select appropriate cyber liability protection for their specific ransomware risk exposure.

Ransomware threats continue evolving as cybercriminals develop new attack methods. Medical offices need comprehensive cyber liability coverage to protect against current and emerging ransomware risks that traditional insurance policies cannot address.

Comments