Workers Comp Secrets Revealed: What Restaurant Cyber Liability Experts Don't Want You to Know

- marketing676641

- Dec 23, 2025

- 5 min read

Restaurant owners focus on workers compensation for obvious reasons: kitchen injuries, slip and fall incidents, and equipment-related accidents. However, a critical connection exists between workplace incidents and cyber liability that most insurance experts never explain. When workplace accidents involve employee data, restaurants face dual exposure that traditional workers comp policies cannot address.

The Hidden Connection Between Employee Data and Cyber Risk

Restaurant cyber liability extends far beyond customer credit card breaches. Employee personal information, payroll systems, and workplace incident documentation create substantial data exposure. When accidents occur, restaurants collect sensitive employee information including Social Security numbers, medical records, injury reports, and emergency contacts. This data becomes a prime target for cybercriminals.

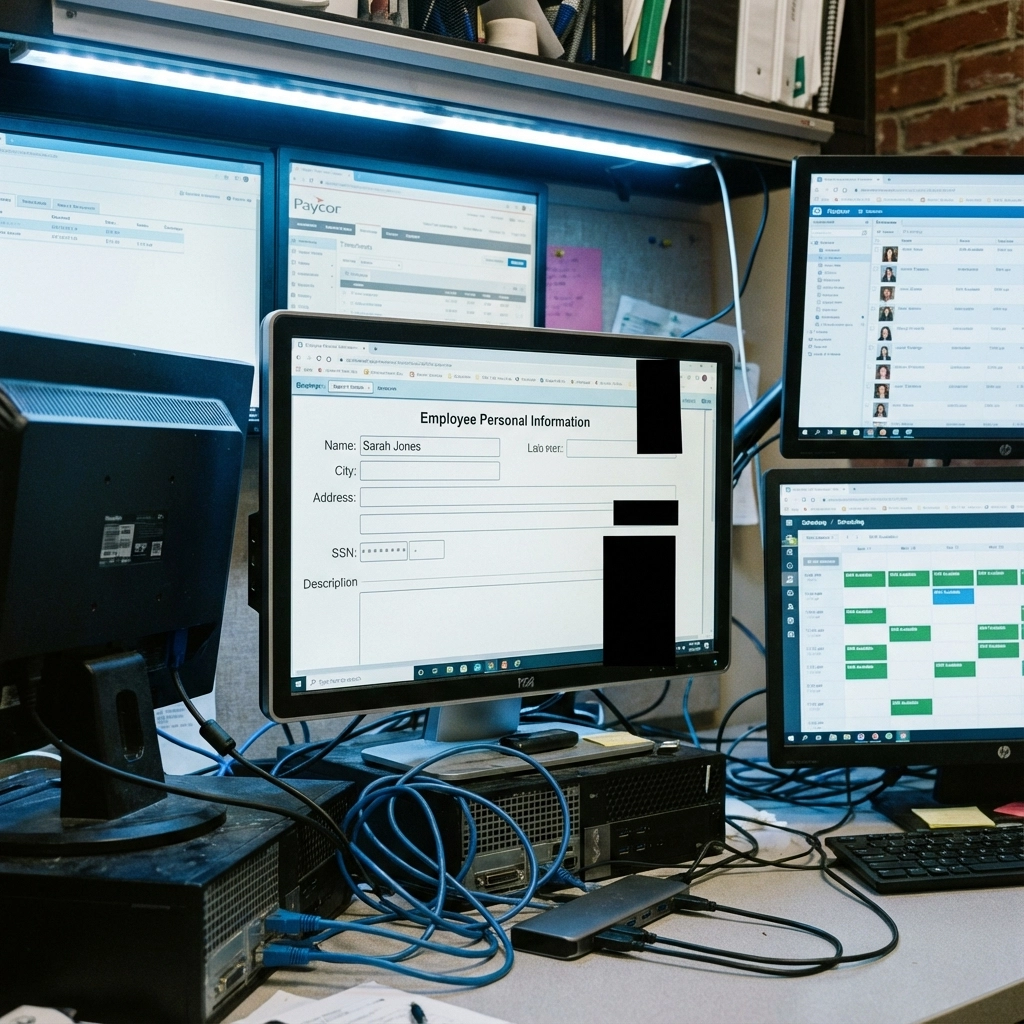

Modern restaurant operations store employee schedules, time clock data, performance reviews, and disciplinary actions electronically. Point-of-sale systems often integrate with payroll platforms, creating interconnected networks containing both customer and employee information. A single breach can compromise years of employee data alongside customer payment information.

Point-of-Sale Vulnerabilities and Employee Information

Restaurant POS systems process more than customer transactions. Employee clock-in data, shift schedules, tip reporting, and payroll integration create extensive employee databases within these systems. When cybercriminals target POS systems, they gain access to employee Social Security numbers, direct deposit information, and personal contact details.

Employee login credentials for POS systems represent another vulnerability. Restaurants often use simple passwords or shared logins across multiple employees. Former employees may retain system access months after termination. These security gaps allow unauthorized access to both transaction data and employee records.

Time and attendance systems connected to POS platforms store employee personal information, including home addresses, phone numbers, and emergency contacts. Cyber incidents affecting these integrated systems expose comprehensive employee data that workers compensation policies cannot protect.

Workplace Incidents That Trigger Data Breaches

Kitchen accidents requiring medical attention generate substantial documentation containing employee personal information. Injury reports include detailed medical histories, insurance information, and treatment records. When restaurants store this documentation electronically, it becomes vulnerable to cyber attacks.

Workers compensation claims processing involves sharing employee data with insurance carriers, medical providers, and legal representatives. Email communications containing sensitive employee information travel through multiple networks, creating numerous breach opportunities. Restaurants often lack encryption protocols for these communications.

Return-to-work programs generate additional employee data including medical clearances, work restrictions, and accommodation requirements. This information requires secure storage and transmission, yet many restaurants use standard email and cloud storage without proper security measures.

Digital Documentation and Data Exposure

Restaurant safety programs require extensive documentation including employee training records, certification tracking, and incident reports. Modern restaurants store this information in digital formats accessible through tablets, smartphones, and cloud platforms. Each access point represents a potential entry for cybercriminals.

Employee handbook acknowledgments, safety meeting attendance, and training completion certificates contain personal identifiers and employment details. Restaurants often store these documents in shared drives or basic cloud storage without encryption or access controls.

Video surveillance systems capturing workplace incidents may include audio recordings of conversations containing employee personal information. When these systems connect to internet networks, they become vulnerable to unauthorized access and data theft.

Integration Risks in Restaurant Technology

Modern restaurants rely on integrated technology platforms connecting POS systems, payroll processing, scheduling software, and inventory management. Employee data flows between these systems continuously, creating multiple exposure points. A breach in one system can compromise employee information across the entire technology infrastructure.

Scheduling applications store employee availability preferences, contact information, and performance metrics. These platforms often lack robust security measures, making employee data vulnerable to unauthorized access. Integration with payroll systems amplifies the potential impact of security breaches.

Mobile applications used by employees for schedule management, time tracking, and communication contain substantial personal information. These apps often store data locally on devices and sync with cloud servers, creating additional security vulnerabilities that workers compensation policies cannot address.

Third-Party Service Provider Risks

Restaurants frequently outsource payroll processing, benefits administration, and workers compensation management to third-party providers. These relationships create additional cyber liability exposure as employee data transfers between multiple organizations and systems.

Payroll service providers maintain comprehensive employee databases including Social Security numbers, banking information, and tax records. Security breaches at these providers can expose restaurant employee data even when the restaurant maintains strong internal security practices.

Benefits administration platforms store employee medical information, family details, and financial data. Cloud-based benefits platforms may share data across multiple client organizations, creating cross-contamination risks during security incidents.

Employee Training and Cyber Security

Restaurant employees receive extensive safety training for workplace hazards but limited cybersecurity education. Staff members frequently access systems using personal devices, shared computers, and unsecured networks. These practices create vulnerabilities that can lead to employee data breaches.

Managers often access employee records from home computers, personal devices, and public Wi-Fi networks. These access patterns increase cyber liability exposure as employee data travels through unsecured networks and storage on personal devices.

Training documentation tracking systems maintain records of employee cybersecurity education, password policies, and access permissions. When these systems lack proper security measures, the documentation intended to improve security becomes a liability.

Protection Strategies for Restaurant Owners

Restaurant cyber liability insurance specifically addresses data breaches involving employee information. This coverage extends beyond workers compensation to include notification costs, credit monitoring services, and legal expenses related to employee data breaches.

Implementing encrypted communication systems for workers compensation documentation protects employee medical information and personal details. Secure email platforms and encrypted file sharing reduce the risk of data interception during claims processing.

Regular security assessments of integrated restaurant technology identify vulnerabilities in systems containing employee data. These assessments evaluate POS integration, payroll system security, and cloud storage practices to minimize cyber liability exposure.

Why Restaurants Need Both Coverages

Workers compensation policies address medical expenses and lost wages from workplace injuries but provide no protection for data breaches involving employee information. Cyber liability insurance fills this coverage gap by addressing the digital aspects of employee data protection.

The intersection of physical workplace incidents and digital data creation requires dual insurance protection. Restaurant owners who understand this connection can better protect their businesses from comprehensive liability exposure involving both physical injuries and data breaches.

Employee data breaches can occur independently of workplace accidents, requiring standalone cyber liability protection. However, workplace incidents often trigger increased data handling and documentation, amplifying cyber risk exposure during already stressful situations.

Real-World Scenarios and Implications

A kitchen fire requiring emergency response generates extensive documentation including employee evacuation procedures, injury assessments, and emergency contact notifications. This sudden increase in data handling creates multiple opportunities for cyber security lapses and unauthorized data access.

Restaurant closures due to workplace incidents require remote access to employee scheduling, payroll, and communication systems. These emergency access situations often bypass normal security protocols, creating vulnerabilities that cybercriminals can exploit.

Workers compensation claim disputes may require sharing employee medical records, performance evaluations, and incident documentation with legal representatives. Without proper cyber liability protection, restaurants face exposure if this sensitive information becomes compromised during transmission or storage.

Understanding the connection between workplace incidents and cyber liability helps restaurant owners make informed insurance decisions. Both workers compensation and cyber liability insurance serve essential roles in protecting restaurants from the comprehensive risks of modern business operations.

Insurance Alliance LLC provides specialized guidance for restaurant owners navigating these complex insurance requirements across Washington, Florida, Texas, Arizona, and Idaho. Our expertise helps restaurant owners understand the full scope of their liability exposure and select appropriate coverage combinations for comprehensive protection.

Comments