Tools & Equipment Insurance: What Every Contractor Needs to Know in 2025

- marketing676641

- Oct 14, 2025

- 5 min read

Your tools and equipment represent the backbone of your contracting business. Without them, work stops, projects get delayed, and revenue disappears. Yet many contractors discover too late that their standard insurance policies provide zero protection for these critical assets.

Tools and equipment insurance fills this dangerous gap. This specialized coverage protects your mobile tools, machinery, and equipment whether they're stored in your truck, used on a job site, or kept in your workshop.

What Tools and Equipment Insurance Actually Covers

Tools and equipment insurance operates as a form of inland marine insurance. This coverage protects your moveable business property wherever it travels: a critical distinction from standard policies that only cover stationary items at fixed locations.

The policy covers an extensive range of contractor equipment. Hand tools like hammers, levels, and measuring devices receive protection. Power tools including drills, saws, grinders, and sanders are covered. Heavy equipment such as backhoes, excavators, and bulldozers qualify for coverage. Specialized machinery like core drills, survey equipment, and welding rigs also receive protection.

Coverage extends beyond tools you own. Many policies protect borrowed or rented equipment when you add this coverage option. Some policies even cover employee tools and work clothing.

Protection Against Multiple Risk Scenarios

Your tools and equipment face numerous threats every day. Theft coverage applies when items are stolen from job sites, vehicles, or storage locations. Construction sites remain prime targets for thieves who know valuable tools are present.

Damage protection covers repair or replacement costs when accidents occur during work. Equipment can be damaged by falling objects, vehicle accidents, or mishaps during transport.

Loss coverage helps when tools are misplaced or lost on busy job sites. Some policies include equipment breakdown coverage for mechanical or electrical failures.

Additional protections can include pollution cleanup costs: such as gas leaked from overturned equipment: and coverage for materials prior to installation.

Why Standard Insurance Policies Leave You Exposed

General liability insurance protects against third-party claims for property damage or bodily injury. It does not cover your own tools and equipment.

Commercial property insurance covers damage to your business premises and permanently installed equipment. It typically excludes mobile tools and equipment used off-site.

This creates a serious protection gap. Your most valuable business assets: the tools that generate your income: remain uninsured under standard policies.

Without proper coverage, a single theft or accident can cost thousands in replacement expenses. These unexpected costs can drain cash reserves and force you to delay projects while waiting to replace essential equipment.

Understanding Coverage Costs and Pricing Factors

Tools and equipment insurance costs vary based on several key factors. The total value of your equipment represents the primary pricing consideration. More valuable or specialized equipment increases your premium.

Basic contractor hand tool coverage typically ranges from $199 to $600 annually. A general contractor with $10,000 worth of tools might pay $300 to $600 per year for comprehensive coverage.

Location factors significantly impact costs. High-theft areas result in higher premiums. Job sites with limited security also increase rates. Urban areas typically cost more than rural locations.

Equipment type affects pricing substantially. Expensive, specialized machinery like excavators costs more to insure than basic hand tools. The insurance company assesses risk based on theft likelihood and replacement costs.

Your claims history influences rates. Contractors with frequent past claims face higher premiums. First-time buyers typically receive standard rates.

Deductible selection impacts your premium. Higher deductibles: the amount you pay before insurance coverage begins: reduce your annual cost. Lower deductibles increase premiums but reduce out-of-pocket expenses during claims.

Policy Structure and Replacement Options

You can structure coverage as replacement cost or actual cash value protection. Replacement cost coverage pays the full amount to replace equipment with new items of similar quality. This option costs more but provides better protection.

Actual cash value coverage considers depreciation. You receive the current market value of your equipment, not the replacement cost. This option costs less but may not fully cover replacement expenses for older equipment.

Some policies include additional benefits beyond basic equipment protection. Coverage for speeding up delayed projects helps maintain schedules after covered losses. Lost income protection compensates for revenue lost due to covered incidents.

Certain policies provide coverage for unscheduled, miscellaneous tools up to specific limits: often $500 per item and $10,000 per occurrence.

Common Exclusions and Limitations

Tools and equipment policies exclude certain situations and conditions. General wear and tear receives no coverage. Normal depreciation and routine maintenance are your responsibility.

Mysterious disappearance often receives limited or no coverage. You typically must prove theft occurred rather than simple loss or misplacement.

Equipment left unsecured may void coverage. Many policies require reasonable security measures like locked vehicles or secured job sites.

Intentional damage by employees or business partners typically receives no coverage. Criminal acts by insured parties are excluded.

Business interruption beyond specific policy limits remains uncovered. Extended project delays may exceed policy benefits.

Selecting the Right Coverage for Your Business

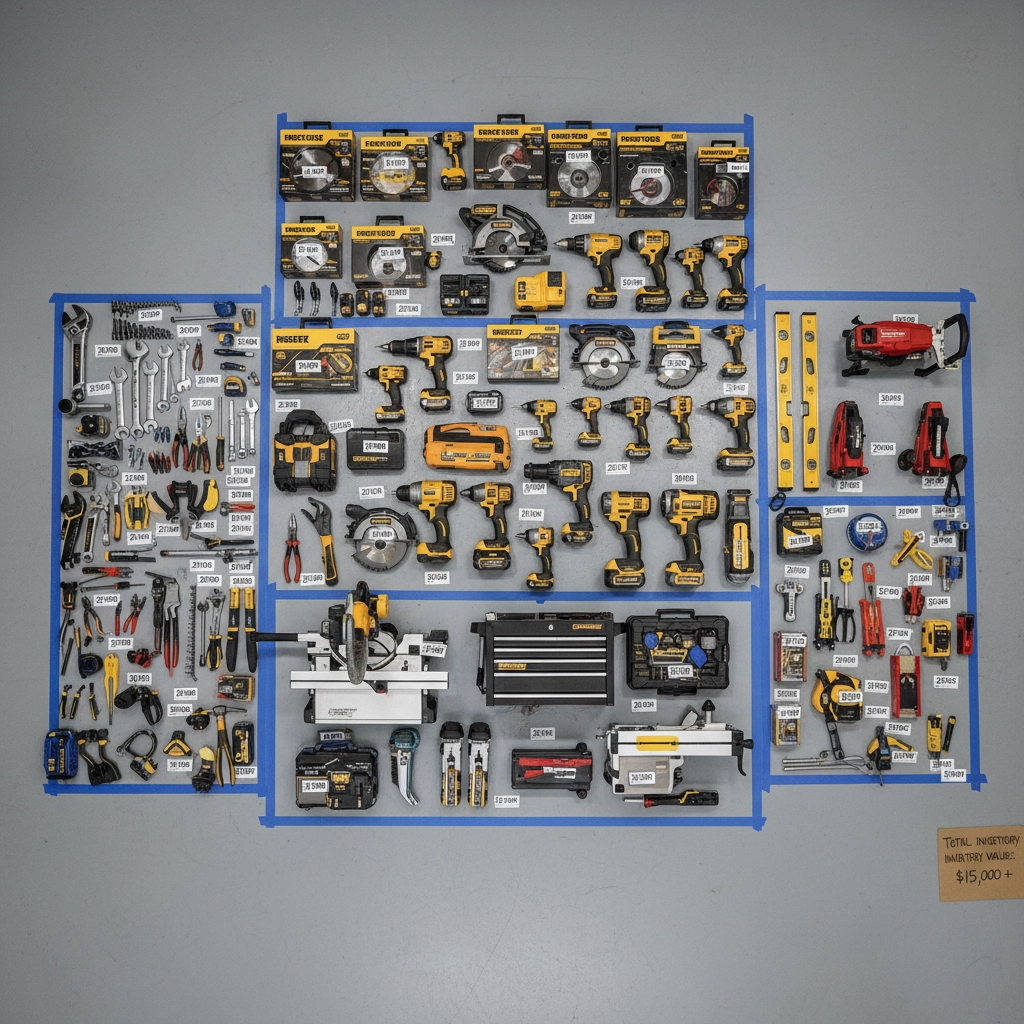

Evaluate your total equipment value accurately. Create a detailed inventory including purchase dates, serial numbers, and current replacement costs. Update this inventory regularly as you acquire new tools.

Consider your specific risks and work environment. Urban contractors face different theft risks than rural operators. Job site security varies significantly between projects.

Review coverage limits carefully. Ensure limits match your actual equipment values. Consider whether you need coverage for rented or borrowed equipment.

Examine deductible options. Higher deductibles reduce premiums but increase your financial responsibility during claims. Balance affordability with acceptable risk levels.

Many contracts require tools and equipment coverage before work begins. Verify coverage requirements with clients before bidding projects.

Compare policies from multiple insurers. Coverage terms, exclusions, and pricing vary significantly between companies.

Theft Trends and Prevention Strategies

Construction equipment theft costs the industry billions annually. Thieves target job sites for valuable, portable tools that are easy to resell.

Common theft scenarios include overnight job site break-ins, vehicle break-ins, and theft from unlocked tool storage. Organized theft rings specifically target construction equipment.

Implement security measures to reduce theft risk and potentially lower insurance premiums. Use locking tool boxes and secure storage containers. Park vehicles in well-lit, secure areas when possible.

Consider GPS tracking for expensive equipment. Many insurers offer discounts for tracked equipment due to improved recovery rates.

Mark tools with unique identifiers. Engraving or permanent marking helps prove ownership and may deter theft.

Document all equipment with photos and serial numbers. Maintain detailed records for insurance claims and theft reports.

Making Claims and Getting Quick Replacements

Report thefts and losses immediately to police and your insurance company. Quick reporting improves recovery chances and speeds claim processing.

Provide detailed documentation including photos, serial numbers, and purchase receipts. Thorough documentation accelerates claim approval.

Work with your insurer to identify quick replacement sources. Many policies provide advance payments to minimize business disruption.

Keep copies of police reports and insurance communications. Organized record-keeping prevents claim delays.

Tools and equipment insurance protects more than just your assets: it protects your ability to earn income and maintain your reputation. Proper coverage keeps your business operational when unexpected losses occur.

Contact Insurance Alliance LLC to discuss tools and equipment coverage options that match your specific contracting needs. Our team understands contractor risks and can help you secure appropriate protection at competitive rates.

Comments