Insurance Essentials for HVAC Contractors: What You Need in 2025

- marketing676641

- Oct 14, 2025

- 5 min read

HVAC contractors face significant risks daily. Equipment malfunctions, property damage, employee injuries, and professional mistakes create potential financial disasters. The insurance landscape changed dramatically in 2025, bringing new requirements that affect every contractor's bottom line.

Understanding your insurance needs protects your business from bankruptcy and legal complications. This guide covers essential coverage types, 2025 regulatory changes, and practical cost considerations for HVAC professionals.

General Liability Insurance: Foundation Coverage

General liability insurance protects against third-party claims for bodily injury, property damage, and personal injury. HVAC contractors need minimum coverage of $1 million per occurrence with $2 million aggregate limits for operations with five or fewer employees.

Larger operations require additional $100,000 coverage per person beyond the initial five employees. Annual premiums typically range from $500 to $1,500, making this the most cost-effective protection available.

Most clients require proof of general liability insurance before signing contracts. This coverage demonstrates professionalism and financial responsibility. Property owners feel confident hiring insured contractors, knowing protection exists if accidents occur.

2025 brings a critical update: completed operations coverage must continue for three years after project completion. This extension addresses delayed construction defects and long-term system failures that emerge after installation.

Common scenarios requiring general liability protection include:

Customer injury from falling HVAC equipment

Property damage during installation or repair

Accidental damage to customer belongings

Slip and fall accidents at job sites

Workers' Compensation: Mandatory for All California Contractors

California implemented sweeping workers' compensation changes in January 2025. All licensed contractors must carry workers' compensation insurance regardless of employee count. This eliminates previous exemptions for sole proprietors and single-person operations.

HVAC contractors with C-20 classifications face strict enforcement. Active workers' compensation coverage is required to maintain licensing status. Failure to comply results in immediate license suspension.

Minimum annual premiums start at $750 for sole proprietors without employees. Contractors with staff pay $2,000 to $5,000 annually per covered employee. Premium increases remain modest in 2025, ranging from flat to 5% above 2024 levels.

Workers' compensation covers:

Medical expenses for job-related injuries

Lost wage replacement during recovery

Rehabilitation costs and retraining

Death benefits for surviving family members

HVAC work presents numerous injury risks including falls from ladders, cuts from sharp metal, electrical shocks, and back injuries from heavy lifting. Workers' compensation provides essential protection for both employees and business owners.

Commercial Auto Insurance

Business vehicles require commercial auto insurance in most states. Personal auto policies exclude coverage for work-related driving and equipment transport.

Commercial auto insurance covers legal expenses, medical bills, and property damage from vehicle accidents. Coverage extends to company-owned trucks, vans, and specialized service vehicles used for HVAC installations and repairs.

Consider higher liability limits when transporting expensive diagnostic equipment or refrigerant materials. Additional coverage options include comprehensive and collision protection for vehicle damage.

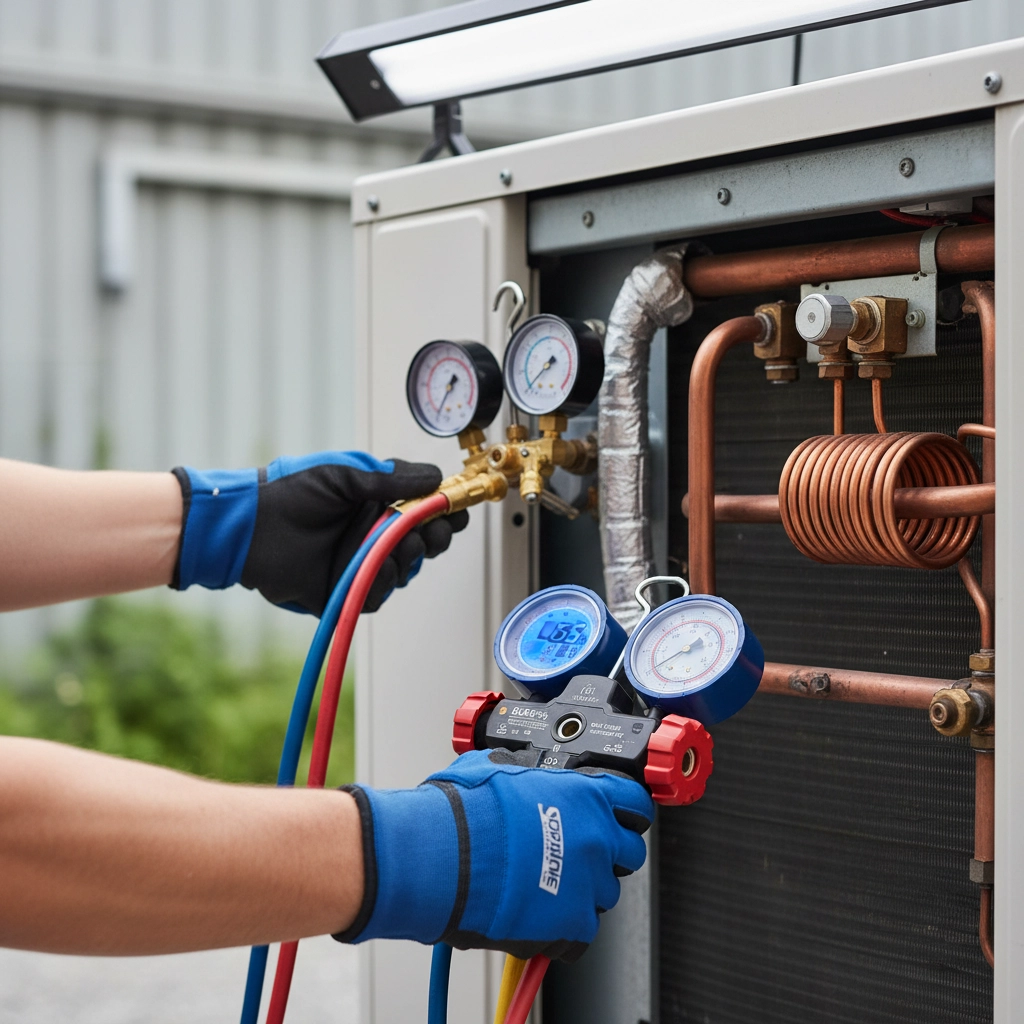

Tools and Equipment Protection

Inland marine insurance protects valuable HVAC tools and equipment. This coverage follows your property to different job sites, addressing theft, damage, and loss risks.

HVAC contractors invest heavily in specialized equipment including:

Digital manifold gauges and diagnostic tools

Refrigerant recovery and charging systems

Pipe bending and cutting equipment

Welding and brazing supplies

Ladder and lifting equipment

Standard commercial property insurance only covers items at fixed business locations. Inland marine insurance provides broader protection for mobile equipment used across multiple work sites.

Coverage typically includes full replacement cost for stolen or damaged tools. Some policies offer temporary equipment rental reimbursement while repairs are completed.

Professional Liability Insurance

Professional liability insurance covers claims arising from work quality issues, design errors, and professional judgment mistakes. HVAC contractors face exposure when system sizing, load calculations, or installation specifications prove inadequate.

Common professional liability scenarios include:

Incorrect system sizing leading to inadequate heating or cooling

Faulty ductwork design causing airflow problems

Installation errors resulting in system failures

Missed permit requirements causing code violations

Professional liability insurance handles legal defense costs and damage settlements when clients claim financial losses from professional mistakes. This coverage fills gaps left by general liability insurance, which excludes professional judgment issues.

Commercial Property Insurance

Commercial property insurance protects business premises, stored inventory, and stationary equipment. HVAC contractors typically maintain warehouses or shops containing valuable parts, tools, and vehicles.

Coverage includes protection against fire, theft, vandalism, and weather damage. Business interruption insurance pays ongoing expenses during repair periods, maintaining cash flow when facilities become unusable.

Annual premiums range from $500 to $2,000 depending on property value and location risks. Business owner's policies combine general liability and commercial property coverage at discounted rates.

Surety Bonds and Performance Requirements

Many states require surety bonds for contractor licensing. California mandates $25,000 surety bonds plus general liability insurance proof before issuing HVAC contractor licenses.

Performance bonds become necessary for larger commercial projects. These bonds guarantee project completion according to contract specifications. Clients receive financial protection if contractors abandon projects or fail to meet obligations.

Surety bond costs depend on personal credit scores and business financial strength. Typical premiums range from 1% to 3% of bond amounts for qualified contractors.

State and Local Compliance Requirements

Insurance requirements vary significantly across different jurisdictions. Colorado's Department of Regulatory Agencies requires general liability insurance for most HVAC work, with surety bonds for larger projects.

Local municipalities often impose additional insurance requirements for permits and licenses. Commercial property leases frequently mandate specific coverage levels and additional insured endorsements.

Government contracts typically require higher insurance limits and specialized coverages. Federal projects may demand cyber liability insurance for contractors handling sensitive information systems.

Cyber Liability Considerations

Smart home technology integration creates new liability exposures for HVAC contractors. Installing connected thermostats, automated controls, and monitoring systems introduces cybersecurity risks.

2025 regulations require specific cyber liability endorsements for contractors implementing smart technologies. Coverage addresses client notification costs, credit monitoring, and legal expenses following data breaches.

HVAC businesses handling customer credit card information need comprehensive cyber protection. Cloud-based scheduling and billing systems create additional vulnerability points requiring coverage.

Cost Management Strategies

Insurance premiums represent significant business expenses requiring careful management. Shopping multiple carriers annually ensures competitive pricing and adequate coverage levels.

Safety programs and loss prevention measures reduce premium costs over time. Regular employee training, equipment maintenance, and job site safety protocols demonstrate risk management commitment to insurance carriers.

Higher deductibles lower annual premiums but increase out-of-pocket expenses during claims. Balance deductible levels against available cash reserves and risk tolerance.

Working with Insurance Alliance LLC

Insurance Alliance LLC specializes in contractor insurance programs designed for HVAC professionals. Our team understands industry-specific risks and regulatory requirements affecting your business.

We provide comprehensive coverage analysis and competitive quotes from multiple carriers. Our goal is matching your specific needs with appropriate protection at affordable premiums.

Contact Insurance Alliance LLC today to review your current coverage and ensure compliance with 2025 requirements. Protect your HVAC business with proper insurance planning and expert guidance.

Comments