Electrician Insurance: Must-Have Coverage for 2025

- marketing676641

- Oct 14, 2025

- 5 min read

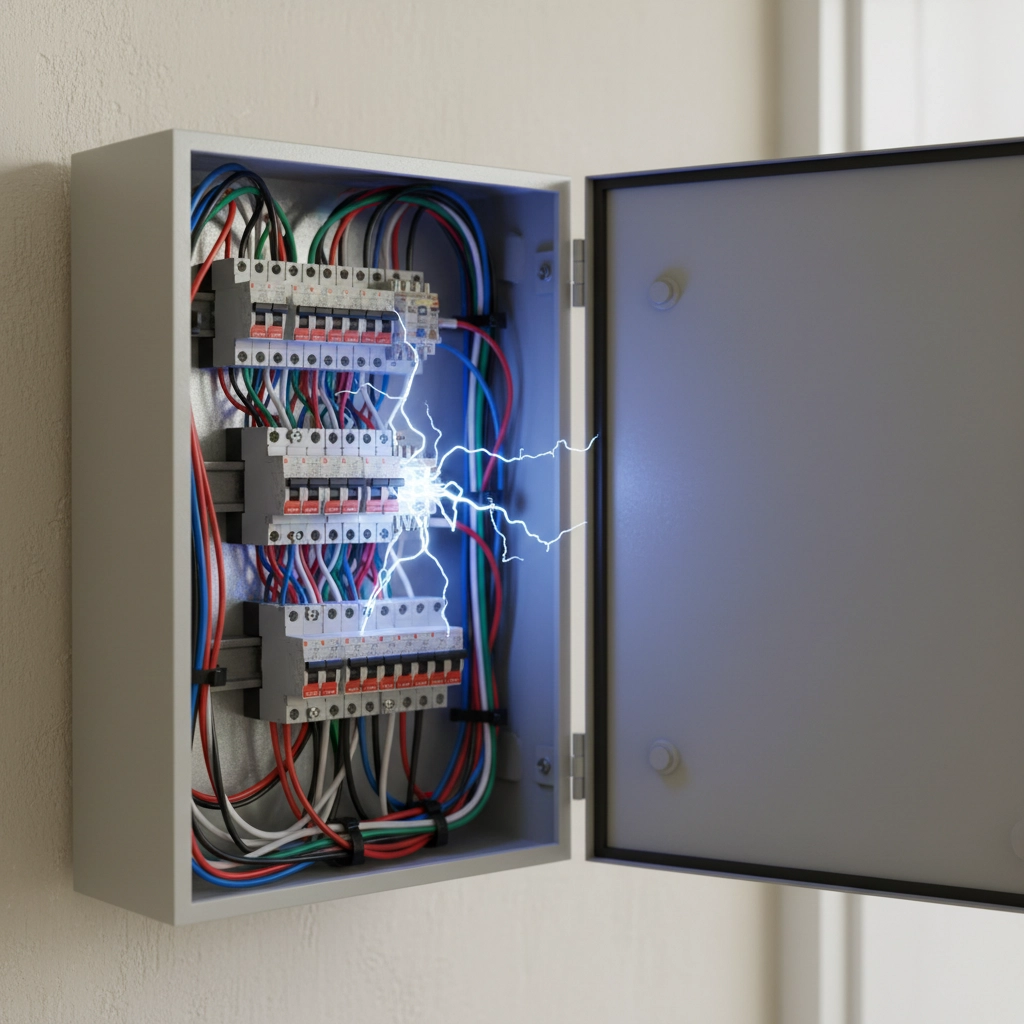

Working with electricity means working with inherent risks every single day. Electrical fires, property damage, workplace injuries, and equipment theft represent just a few of the hazards that can devastate your electrical contracting business financially. The right insurance coverage protects your livelihood and keeps you compliant with state licensing requirements.

Rising insurance claims in the electrical industry make comprehensive coverage more critical than ever in 2025. Understanding which policies you need and what coverage amounts provide adequate protection ensures your business survives unexpected setbacks.

General Liability Insurance: Your Foundation

General liability insurance forms the cornerstone of protection for electrical contractors. This coverage shields your business from third-party claims involving bodily injury or property damage that occurs during your work.

Consider these common scenarios where general liability proves essential. Faulty wiring installation leads to a house fire. A client trips over your extension cord at a job site and breaks their wrist. Your work causes a power surge that damages expensive electronics in a commercial building.

Without general liability coverage, these incidents could result in devastating out-of-pocket expenses. Medical bills, legal fees, and property repair costs add up quickly.

Most electrical contractors should carry at least $1 million in general liability coverage. Many professionals choose $2 million for stronger protection, especially when working on larger commercial projects.

State requirements vary significantly. Texas electrical contractors must maintain minimum coverage of $300,000 per occurrence, $600,000 aggregate, and $300,000 for products and completed operations. Other states may require higher minimums or have different structure requirements.

The cost of general liability insurance typically starts around $500-800 annually for small electrical contractors. Factors affecting your premium include your location, years of experience, type of electrical work performed, and claims history.

Workers' Compensation: Protecting Your Team

Workers' compensation insurance is legally required in every state except Texas. This coverage pays medical expenses and lost wages when employees suffer work-related injuries.

Electrical work presents numerous injury risks. Burns from electrical contact, falls from ladders or scaffolding, cuts from tools and sharp materials, and back injuries from lifting heavy equipment occur regularly in this industry.

Even sole proprietors should consider workers' compensation coverage. It demonstrates professionalism to clients and provides personal protection if you're injured while working.

Workers' compensation costs vary based on your location, number of employees, and safety record. Implementing strong safety programs and maintaining good claims history helps keep premiums manageable.

In Texas, electrical contractors can choose not to carry workers' compensation but must file formal notice with the Texas Department of Insurance. This decision requires careful consideration of the financial risks involved.

Professional Liability: Protecting Against Mistakes

Professional liability insurance, also called errors and omissions coverage, protects against claims arising from mistakes in your electrical design, installation, or consultation work.

This coverage becomes particularly critical when handling complex commercial or industrial projects where errors could result in substantial financial losses. Design flaws, code violations, or improper installation methods that lead to system failures or safety hazards can trigger expensive lawsuits.

Professional liability coverage typically ranges from $500,000 to $2 million per claim. The cost varies based on your project types, revenue, and coverage limits selected.

Claims under professional liability policies have increased significantly in recent years as building systems become more complex and regulatory requirements expand.

Tools and Equipment Coverage

Your tools represent a significant investment that directly impacts your ability to work and generate income. Tools and equipment coverage protects against theft, loss, or damage to your essential work equipment.

Most electrical contractors have between $15,000-50,000 worth of tools at risk. Tool theft from job sites, vehicles, and storage areas occurs frequently in the construction industry.

This coverage ensures quick replacement when tools are stolen or damaged, minimizing downtime that could otherwise cost you thousands in lost revenue while waiting to replace equipment.

Tools and equipment coverage can often be added to your general liability policy or commercial property insurance as an endorsement, making it cost-effective protection.

Commercial Auto Insurance

Commercial auto insurance is essential if you use vehicles to transport equipment or travel to job sites. This coverage protects both your vehicles and any equipment being transported.

Standard personal auto policies typically exclude coverage for business use, leaving gaps in protection when using your vehicle for work purposes.

Commercial auto insurance covers collision damage, liability claims, and theft of vehicles used for business purposes. It also extends coverage to tools and equipment being transported in your vehicle.

Costs depend on the number of vehicles, driver records, and coverage limits selected. Many insurers offer fleet discounts when insuring multiple vehicles.

Commercial Property Insurance

Commercial property insurance protects your workspace and its contents from fire, theft, vandalism, and natural disasters. This applies whether you work from a home office, rent commercial space, or own your building.

Coverage typically includes your building structure, office equipment, inventory, and business personal property. Loss of income coverage can also reimburse lost revenue when property damage forces temporary closure.

Consider the replacement value of all business property when selecting coverage limits. Underinsuring your property could leave significant gaps in protection.

Cyber Liability Insurance: Emerging Essential

Cyber liability insurance has become increasingly important for electricians who maintain websites, use email for business communications, or accept digital payments.

This coverage protects against data breaches, cyberattacks, and identity theft that could compromise client information or disrupt your business operations.

Even small electrical contractors face cyber risks through email phishing, ransomware attacks, and payment processing breaches. The cost of cyber incidents often exceeds what small businesses can absorb without insurance protection.

Basic cyber liability coverage starts around $200-400 annually, making it affordable protection against potentially devastating financial losses.

Understanding Coverage Costs

Electrician insurance costs vary significantly based on multiple factors. Business size, location, type of electrical work, years of experience, and claims history all influence premiums.

Small electrical contractors can expect to pay $2,000-5,000 annually for comprehensive coverage including general liability, workers' compensation, commercial auto, and property insurance.

Many insurers offer business owner's policies (BOPs) that bundle multiple coverage types together at reduced rates compared to purchasing each policy separately.

Working with an experienced insurance agent helps ensure you get appropriate coverage at competitive rates. Agents familiar with electrical contractor risks can identify coverage gaps and recommend cost-effective solutions.

State-Specific Requirements

Insurance requirements for electrical contractors vary significantly by state. Most states require general liability and workers' compensation coverage as conditions for licensing.

Some states mandate specific coverage amounts or require proof of insurance before issuing or renewing electrical contractor licenses. Failing to maintain required coverage can result in license suspension or revocation.

Review your state's electrical contractor licensing requirements regularly, as regulations and minimum coverage amounts change periodically.

Choosing the Right Insurer

Selecting an insurance company experienced with electrical contractor risks ensures better claims handling and more appropriate coverage recommendations.

Look for insurers that offer specialized contractor programs rather than general business insurance. These programs typically provide broader coverage for industry-specific risks at competitive rates.

Financial strength ratings from agencies like A.M. Best indicate an insurer's ability to pay claims. Choose insurers with ratings of A- or better for financial security.

Working with Insurance Alliance LLC

Insurance Alliance LLC specializes in contractor insurance throughout Washington State. Our team understands the unique risks electrical contractors face and the coverage needed to protect your business effectively.

We work with multiple insurance carriers to find competitive rates on comprehensive coverage packages tailored to electrical contractors. Our local expertise helps navigate state-specific requirements and identify coverage options that fit your budget.

Contact Insurance Alliance LLC to review your current coverage and ensure your electrical contracting business has adequate protection for 2025 and beyond.

Proper insurance coverage represents an essential business investment, not an optional expense. The cost of comprehensive coverage pales in comparison to the financial devastation that uninsured claims can cause.

Comments