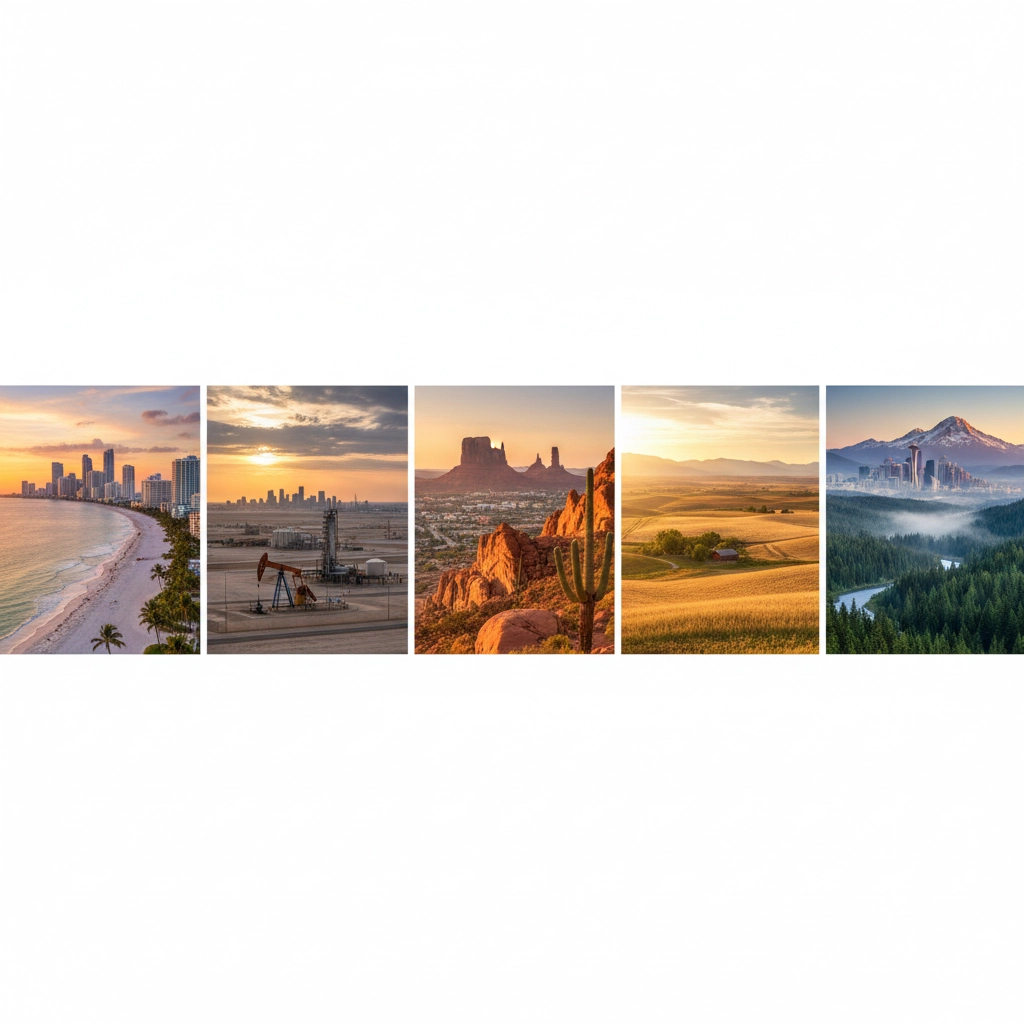

Disability Insurance for Business Owners & Professionals in All Our States

- marketing676641

- Oct 24, 2025

- 5 min read

Disability insurance protects business owners and professionals when injury or illness prevents them from working. This coverage replaces lost income and maintains business operations during disability periods. Business owners in Florida, Texas, Arizona, Idaho, and Washington face unique challenges when disability strikes their primary income source.

Understanding Disability Insurance for Business Owners

Individual disability income insurance provides critical financial protection for business owners who depend on their ability to work. This coverage replaces 60% to 80% of monthly income when disability prevents normal business operations. Benefits typically remain tax-free unless the policy is purchased with pre-tax dollars.

Business overhead coverage operates differently from individual coverage. This insurance reimburses covered business expenses including rent, utilities, employee salaries, and operating costs up to 100% of covered expenses. Business owners can maintain operations while focusing on recovery.

State-Specific Considerations for Our Licensed Areas

Florida Disability Insurance Requirements

Florida business owners benefit from comprehensive disability insurance options without state-mandated requirements for private businesses. Florida's growing economy and diverse professional landscape make income protection essential for business continuity. Self-employed professionals in Miami, Orlando, Tampa, and Jacksonville rely on private disability coverage for financial security.

Texas Business Owner Protection

Texas operates without state disability insurance mandates, placing responsibility on individual business owners to secure coverage. The state's business-friendly environment attracts entrepreneurs who need robust income protection. Dallas, Houston, Austin, and San Antonio business owners face varying cost structures that disability insurance helps manage during recovery periods.

Arizona Professional Coverage Options

Arizona's desert climate and growing tech sector create unique disability considerations. Business owners in Phoenix, Tucson, and Scottsdale benefit from customized disability policies that address state-specific economic factors. Arizona's favorable business climate requires comprehensive income protection strategies.

Idaho Business Disability Planning

Idaho's agricultural and technology sectors present distinct disability risks for business owners. Boise and surrounding areas offer growing professional opportunities that require income protection. Idaho business owners often combine individual and business overhead coverage for comprehensive protection.

Washington State Professional Requirements

Washington maintains specific disability requirements for employees but allows business owners flexibility in coverage selection. Seattle, Spokane, and Tacoma business environments demand sophisticated disability planning. The state's progressive business policies support comprehensive income protection strategies.

Types of Coverage Available

Individual Disability Income Insurance

This foundational coverage protects personal income when injury or illness prevents work. Coverage amounts range from 60% to 80% of monthly salary, with benefit periods extending from two years to retirement age. Own-occupation definitions provide superior protection for professionals with specialized skills.

Business Overhead Expense Coverage

Business overhead disability insurance maintains operations during owner disability. This coverage pays rent, utilities, employee salaries, insurance premiums, and other fixed expenses. Benefits typically extend 12 to 24 months, providing time for recovery or business transition planning.

Key Person Insurance

Business partnerships require protection when disability affects key decision-makers. This coverage allows healthy partners to purchase disabled partners' business interests. Key person insurance maintains business stability and provides exit strategies during extended disability periods.

Business Loan Protection

Business debt continues during disability periods. Loan protection coverage funds business loans, equipment leases, and contractual obligations up to 100% of regular payments. Policy terms align with loan durations, ensuring consistent debt service during recovery.

Policy Features and Definitions

Benefit Periods and Waiting Periods

Benefit periods determine coverage duration, ranging from two years to age 67. Short-term disability provides benefits up to two years, while long-term coverage extends to retirement. Waiting periods, also called elimination periods, span 30 to 365 days before benefits begin.

Definition of Disability

Own-occupation definitions provide benefits when disability prevents work in your specific profession. Any-occupation definitions require inability to perform any reasonable occupation. Business owners typically prefer own-occupation coverage for specialized skills protection.

Premium Structures

Guaranteed renewable policies maintain level premiums throughout the coverage period. Non-cancelable policies provide premium and benefit guarantees. Business owners balance premium costs with benefit levels and policy guarantees based on risk tolerance and cash flow requirements.

Income Replacement Strategies

Calculating Coverage Needs

Business owners require disability coverage that addresses both personal and business expenses. Personal coverage should replace 60% to 80% of individual income, while business coverage handles fixed operational costs. Combined coverage ensures comprehensive financial protection during disability periods.

Tax Considerations

Premium payment methods affect benefit taxation. Premiums paid with after-tax dollars result in tax-free benefits. Business-paid premiums create taxable benefits but provide business tax deductions. Proper structuring optimizes tax efficiency and benefit amounts.

Application Process for Business Owners

Documentation Requirements

Insurance companies require proof of self-employment for at least two years. Tax returns, profit and loss statements, and business licenses verify income and business operations. Professional business owners provide additional documentation including client contracts and revenue projections.

Underwriting Considerations

Business owner underwriting examines income stability, business type, and health status. High-risk occupations face coverage limitations or exclusions. Stable businesses with consistent revenue receive favorable underwriting and premium rates.

Coverage Limitations

Most insurers limit disability benefits to prevent over-insurance. Combined coverage from all sources typically cannot exceed 80% of pre-disability income. Business owners coordinate Social Security Disability, workers' compensation, and private coverage to maximize benefits within regulatory limits.

State Insurance Regulations

Regulatory Differences

Each state maintains unique insurance regulations affecting disability coverage availability and terms. Florida, Texas, Arizona, Idaho, and Washington provide competitive insurance markets with diverse coverage options. State insurance departments oversee policy terms, premium rates, and claim practices.

Professional Licensing Considerations

Licensed professionals in healthcare, law, accounting, and other fields face specific disability risks. Professional liability and disability coverage coordinate to protect licenses and practice continuation. State licensing boards may require specific coverage amounts or types.

Business Continuity Planning

Succession Planning Integration

Disability insurance integrates with business succession plans to ensure smooth transitions. Buy-sell agreements coordinate with disability benefits to fund ownership transfers. Proper planning prevents forced business sales during disability periods.

Employee Considerations

Business owner disability affects employee security and business operations. Comprehensive planning includes employee retention strategies and operational continuity procedures. Disability coverage provides resources to maintain payroll and benefits during recovery periods.

Claim Management and Benefits

Claim Filing Procedures

Disability claims require prompt notification and complete documentation. Medical records, physician statements, and work history support benefit determinations. Proper claim management ensures timely benefit payments and minimizes coverage disputes.

Return-to-Work Programs

Many disability policies include return-to-work incentives and partial benefit options. These programs support gradual work resumption while maintaining income protection. Business owners benefit from flexible return-to-work arrangements during recovery periods.

Choosing the Right Coverage

Business owners in Florida, Texas, Arizona, Idaho, and Washington need comprehensive disability planning that addresses individual circumstances and state-specific considerations. Proper coverage selection protects income, maintains business operations, and provides financial security during challenging periods.

Insurance Alliance LLC helps business owners and professionals throughout our licensed states develop comprehensive disability insurance strategies. Our expertise in Florida, Texas, Arizona, Idaho, and Washington markets ensures appropriate coverage selection and optimal benefit design for your specific needs.

Contact Insurance Alliance LLC to review your disability insurance options and protect your most valuable asset – your ability to earn income. Our professional team provides personalized guidance for business owners and professionals across all our licensed states.

Comments