Commercial Auto Insurance Secrets Revealed: What Restaurant Delivery Operations Don't Want You to Know About Third-Party Gaps

- marketing676641

- Dec 9, 2025

- 5 min read

Restaurant owners using third-party delivery services face hidden insurance gaps that create substantial liability exposure. DoorDash, Uber Eats, and similar platforms carry their own insurance coverage, but these policies leave critical protection gaps that many restaurant operators never discover until claims arise.

Understanding these coverage gaps protects your restaurant from unexpected liability and ensures comprehensive protection for your delivery operations.

The Third-Party Coverage Misconception

Third-party delivery platforms maintain insurance policies designed primarily to protect their drivers and operations. Restaurant owners often assume this coverage extends full protection to their businesses, creating a dangerous misconception about liability exposure.

Platform insurance policies typically cover driver injuries, vehicle damage, and basic liability scenarios involving their contracted drivers. However, these policies contain specific exclusions and limitations that leave restaurants exposed to liability claims the platform insurance will not address.

The coverage structure becomes complex when accidents occur during food delivery. Platform insurance may cover certain driver-related incidents while excluding restaurant-specific liability scenarios, creating gaps in protection that restaurant owners must address through their own commercial insurance policies.

Critical Coverage Gaps in Third-Party Delivery

Food Quality and Safety Liability

Third-party delivery insurance does not cover liability arising from food contamination, spoilage, or quality issues during transport. When customers become ill from food that arrived damaged or improperly handled during delivery, restaurants face direct liability exposure regardless of using third-party services.

Platform drivers operate under time pressure and may lack proper food safety training. Temperature control failures, cross-contamination, and improper handling during delivery create liability risks that fall outside third-party insurance coverage scope.

Restaurants remain legally responsible for food safety throughout the entire delivery process, including third-party transport phases. This responsibility continues even when restaurants have no direct control over delivery handling practices.

Property Damage at Customer Locations

Delivery drivers access customer properties daily, creating opportunities for property damage incidents. When drivers damage customer homes, apartments, or business properties during delivery, restaurants can face liability claims that third-party insurance may not cover.

Platform insurance typically focuses on vehicle-related incidents rather than property damage claims at delivery locations. Customer property damage during food delivery often falls into coverage gaps between driver insurance and platform policies.

Restaurants may face direct liability exposure when customers pursue property damage claims related to delivery incidents. Third-party platform insurance may deny coverage if the incident falls outside their specific policy terms and conditions.

Customer Injury Claims

Customer injuries during food delivery create complex liability scenarios involving multiple parties. When delivery-related accidents injure customers, both the driver and the restaurant may face liability claims that require separate insurance coverage.

Platform insurance may cover driver liability while excluding restaurant liability for the same incident. Customers injured during delivery often pursue claims against all parties involved, including the restaurant that prepared and ordered the delivery.

Joint liability scenarios require restaurants to maintain their own liability coverage rather than relying solely on third-party platform insurance. Coverage gaps in these situations can expose restaurants to significant uninsured liability.

Contractual Liability Transfer

Third-party delivery platforms often require restaurants to accept liability through service agreements and terms of use. These contractual obligations can transfer liability back to restaurants for incidents the platform claims fall outside their insurance coverage.

Indemnification clauses in platform agreements may require restaurants to protect the platform against certain liability claims. This contractual liability transfer means restaurants could become financially responsible for incidents they assumed were covered by platform insurance.

Platform service agreements frequently contain liability allocation terms that favor the delivery service over participating restaurants. Understanding these contractual obligations helps restaurants identify additional insurance coverage needs.

Insurance Coordination Problems

Restaurant general liability policies may exclude coverage for delivery operations when third-party services are used. This exclusion creates a coverage void that neither the restaurant's existing insurance nor the platform's insurance addresses.

Commercial auto insurance coordination becomes complex when multiple parties and policies are involved in delivery operations. Coverage disputes between insurance carriers can leave restaurants without protection during claim scenarios.

Non-owned vehicle liability coverage becomes essential for restaurants using third-party delivery services. This coverage protects restaurants when liability claims arise from delivery operations involving vehicles the restaurant does not own or control.

Hidden Exclusions in Platform Policies

Platform insurance policies contain specific exclusions that limit coverage scope for restaurant-related incidents. These exclusions often apply to scenarios involving food preparation, restaurant negligence, or liability claims that originate from restaurant operations rather than delivery activities.

Driver insurance policies may exclude commercial activities, creating gaps when personal vehicle insurance does not cover delivery work. Platform supplemental insurance may not fill all gaps left by inadequate driver coverage.

Coverage limitations in platform policies often apply during specific time periods or operational phases. Understanding when platform coverage applies and when gaps exist helps restaurants identify supplemental insurance needs.

Essential Commercial Auto Protection

Restaurants using third-party delivery services require non-owned vehicle liability coverage to address protection gaps. This coverage protects restaurants when liability claims arise from delivery operations involving vehicles the restaurant does not own or operate.

Hired auto liability coverage provides additional protection when restaurants contract with delivery services or independent drivers. This coverage addresses liability scenarios that may fall outside platform insurance scope.

Commercial auto insurance with appropriate endorsements ensures comprehensive protection for restaurant delivery operations regardless of whether restaurants use their own drivers or third-party services.

Documentation and Risk Management

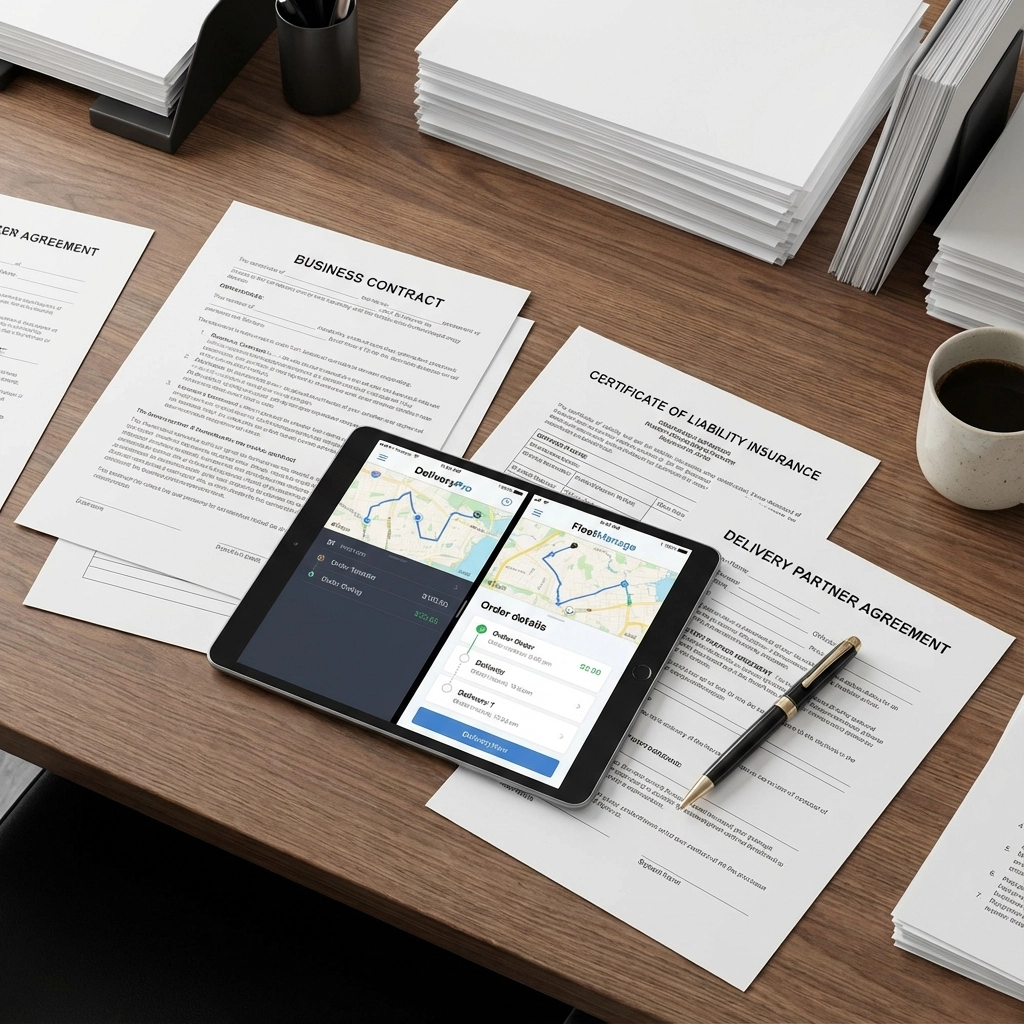

Restaurants should maintain detailed records of third-party delivery arrangements and insurance requirements. Documentation helps establish coverage responsibilities and identifies potential gaps in protection.

Certificate of insurance requests from delivery platforms verify coverage limits and policy terms. Understanding platform insurance details helps restaurants make informed decisions about supplemental coverage needs.

Regular insurance policy reviews ensure restaurant coverage keeps pace with delivery operation changes and platform policy modifications. Professional insurance guidance helps identify emerging coverage gaps and protection needs.

Professional Insurance Guidance

Insurance professionals specializing in restaurant coverage understand the complex liability scenarios involving third-party delivery operations. Expert guidance helps restaurants navigate coverage gaps and ensure comprehensive protection.

Commercial insurance agents can coordinate coverage between restaurant policies and third-party platform insurance to minimize gaps. Professional analysis identifies specific risks that require additional coverage or policy modifications.

Working with experienced insurance professionals ensures restaurants maintain appropriate coverage for evolving delivery operation models and platform arrangements.

The reality of third-party delivery operations involves significant insurance complexity that restaurant owners must address through comprehensive commercial coverage. Understanding these gaps and implementing appropriate protection strategies ensures restaurants maintain adequate liability coverage regardless of delivery operation methods.

Insurance Alliance LLC provides specialized guidance for restaurant commercial auto insurance needs, including coverage for third-party delivery operations. Contact our team to review your restaurant's delivery operation insurance requirements and identify protection gaps that need addressing.

Comments