Business Owners Policy (BOP) for Medical Offices in Florida, Texas, Arizona, Idaho, and Washington

- marketing676641

- Dec 13, 2025

- 5 min read

Medical offices face unique risks that require comprehensive insurance protection. A Business Owners Policy (BOP) provides essential coverage by combining property insurance and general liability insurance into a single, streamlined package designed specifically for medical practices.

Insurance Alliance LLC helps medical offices across Florida, Texas, Arizona, Idaho, and Washington secure proper BOP coverage that addresses the specific risks and exposures common to healthcare environments.

Understanding BOP Coverage for Medical Practices

A Business Owners Policy serves as the foundation of insurance protection for medical offices. This bundled coverage addresses multiple risk exposures through a single policy, simplifying insurance management while providing comprehensive protection.

Medical offices benefit from BOP coverage because it addresses both property-related risks and liability exposures that healthcare practices encounter daily. The policy structure accommodates the unique operational characteristics of medical facilities, from expensive diagnostic equipment to patient care responsibilities.

Property Coverage for Medical Equipment and Facilities

Property coverage within a medical office BOP protects the physical assets essential to healthcare operations. This includes protection for medical equipment, diagnostic machinery, office furniture, computers, and patient records.

Medical offices typically house expensive equipment such as X-ray machines, ultrasound devices, laboratory equipment, and specialized treatment tools. Property coverage helps replace or repair these essential items when covered perils cause damage.

The coverage extends to the building structure itself when the medical practice owns the property. This includes protection against fire, lightning, windstorm, hail, explosion, vandalism, and theft.

Business personal property coverage protects movable items within the medical office. This encompasses office supplies, medications, patient files, computers, and furniture. The coverage applies whether these items are located on the premises or temporarily moved to other locations for business purposes.

General Liability Protection for Patient Interactions

General liability coverage addresses third-party claims alleging bodily injury or property damage occurring on the medical office premises. This protection covers incidents involving patients, visitors, delivery personnel, and other third parties who enter the facility.

Medical offices see high patient traffic daily, creating numerous opportunities for slip-and-fall accidents, injuries from equipment, or damage to patient property. General liability coverage responds to these exposures by providing legal defense and settlement costs when covered claims arise.

The coverage includes protection against allegations of personal and advertising injury, such as claims involving invasion of privacy, wrongful eviction, or defamation. These exposures can arise in healthcare settings through patient interactions or marketing activities.

Product liability protection within the general liability coverage addresses claims involving products sold or distributed by the medical office, such as medical devices, supplements, or other healthcare products provided to patients.

Business Interruption and Extra Expense Coverage

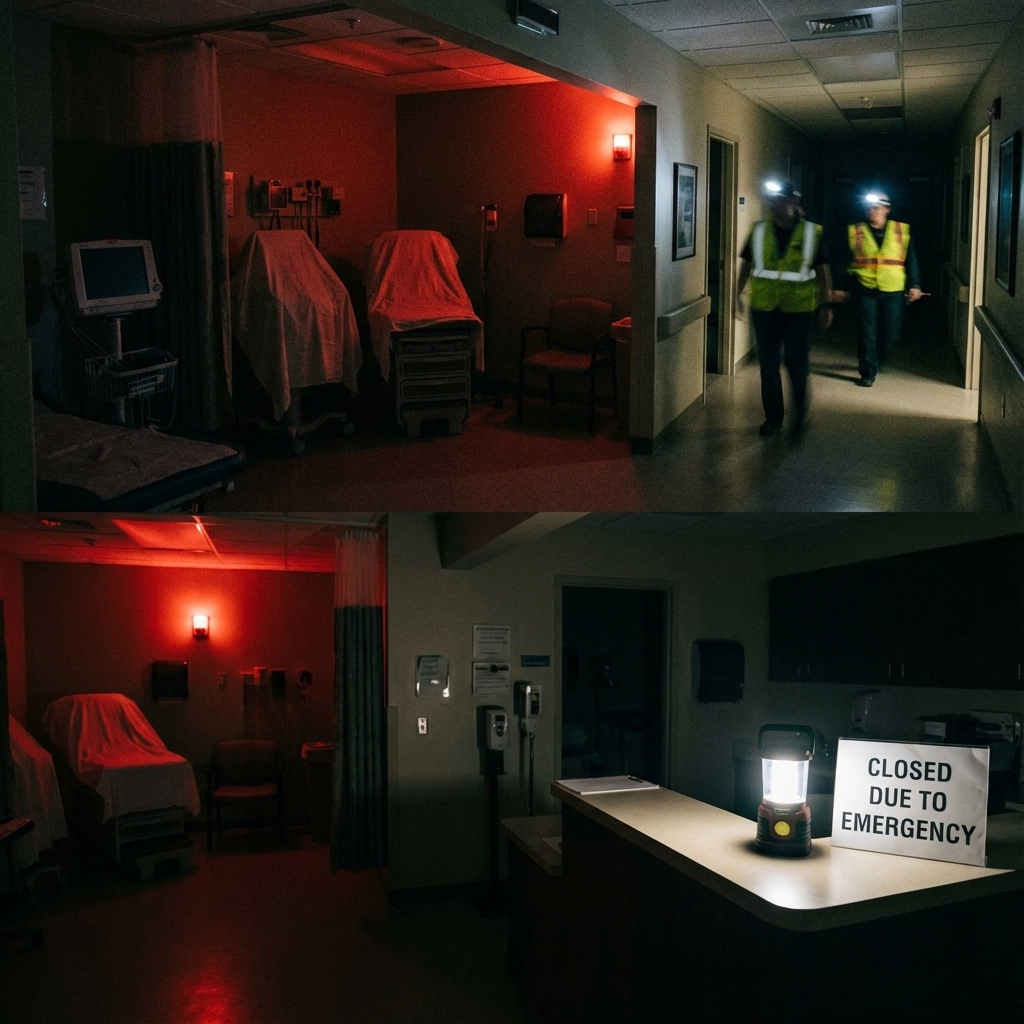

Business interruption coverage provides financial protection when covered perils force temporary closure of the medical office. This coverage helps replace lost income during the period of restoration and covers continuing expenses that persist even when operations stop.

Medical practices depend on consistent operations to serve patients and generate revenue. When disasters damage the facility or equipment, business interruption coverage helps maintain financial stability during the recovery period.

Extra expense coverage addresses additional costs incurred to maintain operations during repairs or rebuilding. This might include expenses for temporary office space, equipment rental, or expedited repair services to minimize business disruption.

The coverage calculation typically bases on the medical office's financial records, considering factors such as net income, continuing expenses, and normal operating patterns. This ensures adequate protection that reflects the practice's actual financial exposure.

Additional Coverage Options for Medical Offices

Medical offices can enhance their BOP with additional coverages that address specific healthcare industry risks. Professional liability insurance protects against claims arising from medical malpractice, errors in diagnosis, or failure to provide adequate treatment.

Cyber liability coverage addresses risks related to electronic patient records, billing systems, and other technology-dependent operations. Medical offices handle sensitive patient information that requires protection against data breaches, cyber attacks, and regulatory violations.

Employment practices liability coverage protects against claims from employees alleging discrimination, harassment, wrongful termination, or other workplace violations. Medical offices with staff members benefit from this protection given the complex employment relationships in healthcare settings.

Equipment breakdown coverage addresses mechanical or electrical failure of essential medical equipment. This coverage provides repair or replacement costs for equipment failures not covered under standard property coverage.

Risk Management for Medical Office Operations

Medical offices face specific risks that BOP coverage helps address. Patient safety represents a primary concern, as healthcare environments create numerous opportunities for accidents or injuries. Proper insurance coverage provides protection when safety incidents result in liability claims.

Technology dependence creates additional risks for modern medical practices. Electronic health records, billing systems, and diagnostic equipment rely on technology that can fail or become compromised. Comprehensive coverage addresses both property damage and business interruption from technology failures.

Regulatory compliance requirements in healthcare create potential exposures for medical offices. BOP coverage includes provisions that help address costs associated with regulatory investigations or violations, depending on the specific policy terms.

Staff-related risks emerge from employment relationships and workplace interactions. Medical offices employ various professionals with different roles and responsibilities, creating potential exposures for employment-related claims.

Property Protection for Specialized Medical Equipment

Medical offices typically house equipment requiring specialized replacement considerations. Diagnostic machinery often requires specific manufacturers, installation requirements, and calibration procedures that standard property coverage might not fully address.

Replacement cost coverage ensures that damaged equipment receives replacement with comparable new items rather than depreciated value settlements. This protection maintains the medical office's operational capabilities without forcing practices to accept inferior replacement equipment.

Business personal property coverage includes protection for patient records, whether maintained in physical or electronic format. Medical offices must maintain comprehensive patient documentation, and loss of these records can create both operational and legal challenges.

Tenant improvements and betterments coverage protects investments made in leased medical office space. Many medical practices lease their facilities and invest significantly in improvements such as specialized electrical systems, plumbing modifications, or structural changes to accommodate medical equipment.

Liability Considerations for Healthcare Environments

Medical office liability exposures extend beyond standard business operations. Patient interactions create unique risks involving medical advice, treatment recommendations, and healthcare-related communications.

Premises liability concerns include traditional slip-and-fall risks as well as healthcare-specific exposures such as infections acquired on the premises or injuries from medical equipment. BOP general liability coverage addresses these exposures through comprehensive third-party protection.

Professional liability exposures require separate consideration beyond standard BOP coverage. Medical practices typically require professional liability insurance that specifically addresses malpractice claims, treatment errors, and professional negligence allegations.

Product liability considerations arise when medical offices provide medical devices, pharmaceuticals, or other healthcare products to patients. General liability coverage within the BOP includes product liability protection for these exposures.

Business Continuity Planning with BOP Coverage

Business interruption coverage supports continuity planning for medical offices facing operational disruptions. Healthcare practices cannot easily defer patient care, making rapid recovery essential for both patient welfare and business survival.

Coverage helps fund temporary locations when primary facilities become unusable. Medical offices can continue serving patients from alternative locations while repairs or rebuilding occurs at the main facility.

Equipment replacement provisions ensure rapid restoration of essential medical capabilities. The coverage includes expedited replacement services and temporary equipment options that minimize interruptions to patient care.

Income protection through business interruption coverage maintains financial stability during recovery periods. Medical offices can continue meeting payroll, lease obligations, and other fixed expenses even when revenue generation stops temporarily.

Working with Insurance Alliance LLC

Insurance Alliance LLC provides specialized BOP coverage for medical offices throughout Florida, Texas, Arizona, Idaho, and Washington. Our team understands the unique risks facing healthcare practices and designs coverage solutions that address these specific exposures.

We work directly with medical office owners and administrators to evaluate coverage needs, compare policy options, and implement comprehensive protection strategies. Our approach considers both current operations and future growth plans to ensure adequate long-term protection.

Contact Insurance Alliance LLC to discuss BOP coverage options for your medical office. Our experienced team provides guidance on coverage selection, policy customization, and risk management strategies designed specifically for healthcare practices.

Visit our healthcare office insurance page to learn more about comprehensive insurance solutions for medical practices.

Comments