Why Commercial Auto Insurance is Essential for Florida Businesses

Running a business in Florida means having to navigate a range of unique risks and challenges. Whether you own a fleet of vehicles, rely on delivery trucks, or use company cars for employee travel, commercial auto insurance is a must-have to protect your business assets and ensure smooth operations. In Florida, where weather-related risks, high traffic volumes, and liability concerns are common, commercial auto insurance provides essential coverage that goes beyond a standard personal auto policy.

Here’s why commercial auto insurance is crucial for your Florida business.

1. Florida’s Unique Driving Conditions and Risks

Florida is known for its heavy traffic, frequent rainstorms, and its status as a prime location for tourists. These factors combine to create a higher-than-average risk of accidents, making commercial auto insurance especially important. With nearly 20 million residents and millions of tourists visiting the state each year, road congestion is a constant concern.

In addition to everyday driving risks, Florida is also prone to natural disasters like hurricanes, which can cause significant damage to vehicles, especially for businesses that rely on transportation for operations.

2. State-Mandated Insurance Requirements

In Florida, commercial vehicles must meet certain minimum coverage requirements, but these may not be sufficient to fully protect your business. Florida law mandates that all drivers carry the following minimum coverage:

- $10,000 in Property Damage Liability (PDL): Covers the damage you cause to other people's property in an accident.

- $10,000 in Personal Injury Protection (PIP): Covers medical bills and lost wages for the driver and passengers, regardless of fault.

However, these minimums may not provide adequate protection, especially if your vehicle causes significant damage or injury. For businesses with multiple vehicles, it’s crucial to evaluate your risks and opt for higher limits of coverage.

3. Protect Your Business Assets

Commercial auto insurance provides coverage for a range of potential issues that can arise while driving for business purposes. This coverage extends beyond personal auto insurance by addressing the needs of businesses that rely on vehicles for revenue-generating activities. Some of the key components of commercial auto insurance include:

- Liability Coverage: Protects your business if your vehicle is involved in an accident where you or your employee is at fault. This includes bodily injury liability and property damage liability.

- Collision Coverage: Covers the cost of repairing or replacing a vehicle after a collision, regardless of fault. This is especially important for businesses that rely on vehicles for deliveries, transport, or other operational needs.

- Comprehensive Coverage: Protects your business vehicles from damage caused by non-collision incidents, such as theft, vandalism, natural disasters (like hurricanes), or hitting an animal.

- Medical Payments Coverage: Covers medical expenses for drivers and passengers in the event of an accident.

- Uninsured/Underinsured Motorist Coverage: Given that Florida has one of the highest rates of uninsured drivers in the country, this coverage protects your business if you're involved in an accident with a driver who lacks sufficient insurance.

4. Protecting Employees and Fleet Vehicles

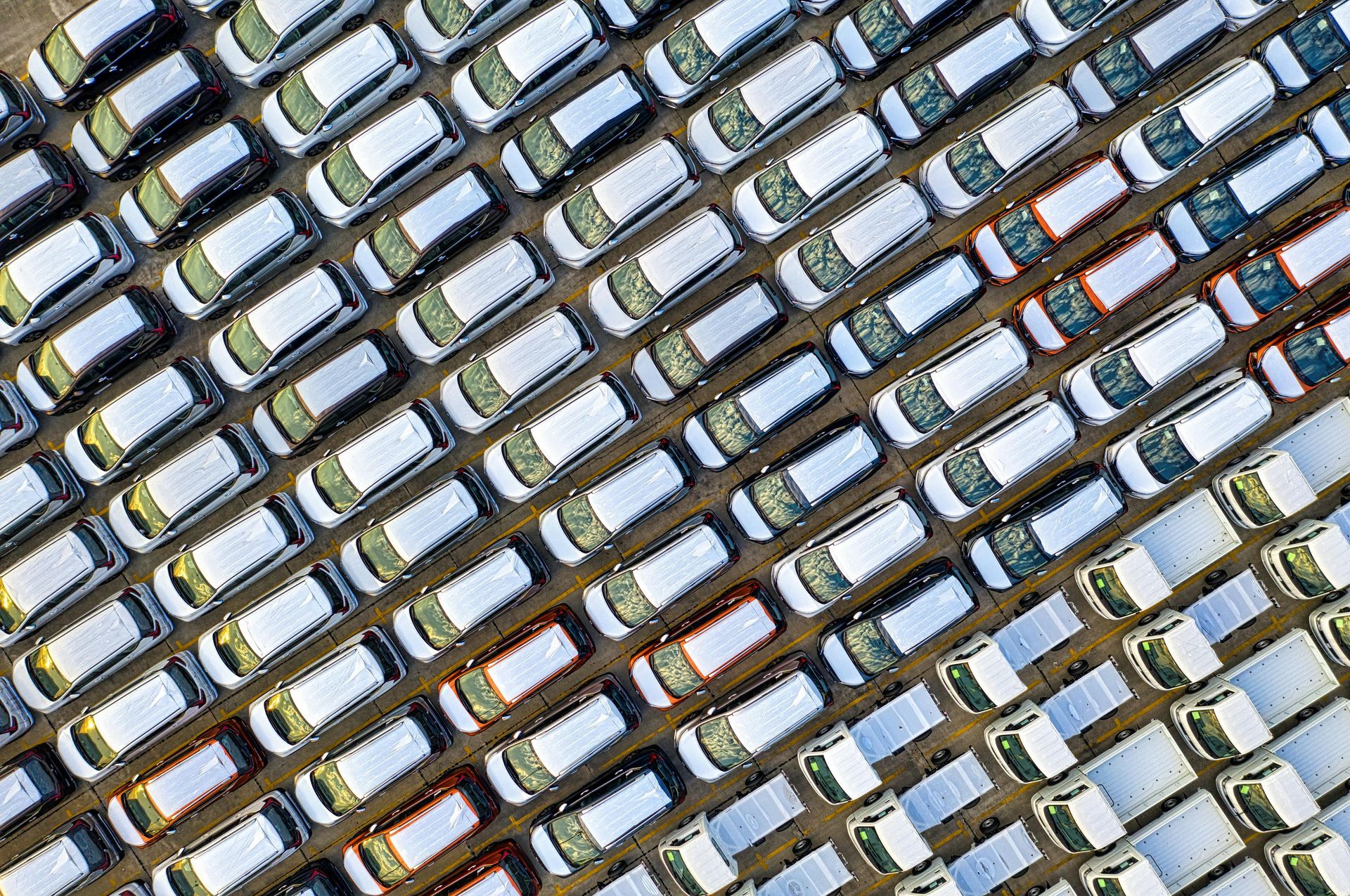

If your business uses a fleet of vehicles, it’s essential to have coverage that extends to all drivers operating those vehicles. Commercial auto insurance can cover not just company-owned vehicles but also vehicles that are leased, rented, or used by employees for business purposes.

- Employee-Related Coverage: Whether employees are using company vehicles or their own cars for business tasks, your policy can provide coverage in the event of an accident while they are on the job.

- Fleet Insurance: For businesses with multiple vehicles, fleet insurance is a more cost-effective option to insure several vehicles under a single policy. Fleet insurance allows you to customize coverage for each vehicle depending on its usage, type, and other factors.

5. Financial Protection for Your Business

Without the proper commercial auto insurance, your business could face significant financial consequences if an accident occurs. Even minor accidents can lead to substantial repair costs, medical bills, and lawsuits. In the case of a serious incident, the expenses can be enough to put your business at risk of closure.

Commercial auto insurance provides a financial safety net, allowing your business to recover more quickly from accidents, injuries, or property damage. It helps protect your bottom line from the unexpected costs that can arise from road incidents.

6. Peace of Mind for Business Owners

As a business owner, the last thing you want to worry about is whether your vehicles are adequately covered in the event of an accident. Commercial auto insurance gives you the peace of mind that you are protected from the wide variety of risks your business vehicles face on the road. Whether it's a fender bender, a theft, or a catastrophic accident, you’ll have the coverage you need to keep your business moving forward.

7. Why Choose Insurance Alliance for Your Commercial Auto Insurance?

At Insurance Alliance, we understand the unique risks that businesses in Florida face and are committed to helping you find the right commercial auto insurance coverage for your needs. Our team works with a variety of insurance carriers to offer flexible options tailored to your business size, budget, and industry. Whether you own a small delivery service or a large fleet, we’ll help you navigate the complexities of commercial auto insurance and provide you with a comprehensive policy that suits your business.

Conclusion

Commercial auto insurance is an essential tool for protecting your business in Florida. It not only ensures that your vehicles are covered in the event of accidents but also provides critical protection for your employees, your business assets, and your bottom line. Given Florida’s high risk of accidents, weather-related incidents, and its large number of uninsured drivers, it’s crucial to make sure your business is properly covered.

At Insurance Alliance, we’re here to guide you in selecting the best commercial auto insurance policy to meet your needs. Contact us today to get started and ensure your business is fully protected on the road.